Realty growth sinks to single-digit level

By ZHENG YANGPENG (China Daily) Updated: 2015-04-16 07:40

|

|

|

A man inspects a property model display on June 14, 2014 in Rizhao, Shandong province. [File photo/provided to China Daily] |

Housing sales remain soft despite several policy easing measures announced by government

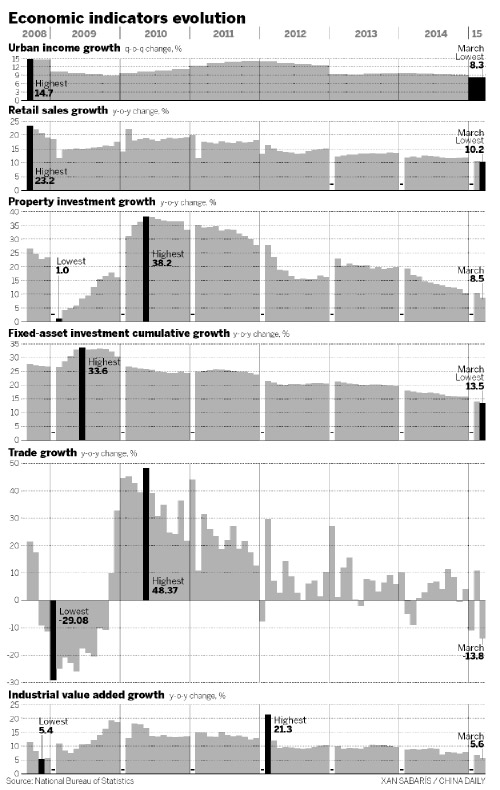

First-quarter investment in the real estate industry plunged to the lowest point in nearly six years, according to data released by the National Bureau of Statistics on Wednesday.

Investment in the property sector, a pillar of China's fixed-asset investment, expanded by 8.5 percent year-on-year, dipping from 10.4 percent in the first two months.

The pace of growth was the weakest since July 2009, which was the aftermath of the global financial crisis, and a far cry from the 30 percent-plus rates recorded just four years ago.

In the previous property downturn, which occurred in the second and third quarters of 2012, growth rates remained above 15 percent.

"China's property sector is still in a bad way. Prices continue to slide. Without a turnaround in loan growth, it's difficult to see a rebound in real estate," said Tom Orlik, chief Asia economist of Bloomberg.

Statistics suggest that investment growth in the sector is set for further slowdowns, which would drag down overall economic growth.

For example, funds raised by developers in the first quarter contracted 2.9 percent year-on-year, while new housing starts plunged 18.4 percent.

Yu Bin, a leading scholar with the Development Research Center of the State Council (cabinet), told a news conference earlier that real estate investment growth will decelerate further from 10.5 percent last year to about 7 percent this year. That would be about the same pace as the target for GDP growth.

In the longer term, property investment growth will stabilize in the 7 to 8 percent range, he said.

Investment is a lagging indicator that usually runs about three months behind changes in actual home sales, experts said. Given that relationship, last month's sales performance implies that investment will stabilize in the second half of this year.

- Russian experts see economic, strategic benefits from AIIB membership

- Nippon Paint Spreads a Coat of Love in Sichuan

- 2 new types of stock index futures start trading

- Q1 economic data: what the economists say

- China's Q1 FDI jumps 11.3%

- Report urges localized urbanization for China's underdeveloped regions

- Infographic: What do we know about AIIB

- China sees continued surge in new firms