Property prices recover in May as demand rises

By Zheng Yangpeng (China Daily) Updated: 2015-06-19 07:20

Bullish stock market generates wealth, fuels renewed enthusiasm for home purchases

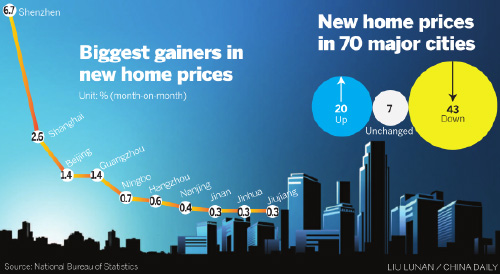

The average new home prices in China edged up month-on-month in May, ending a 12-month losing streak and fueling hope that the market has bottomed out.New home prices rose in 20 of the 70 cities tracked by the government, the National Bureau of Statistics said on Thursday, compared with 18 in April. That translated into a 0.06 percent month-on-month gain in the national average, compared with a 0.12 percent decline in April, based on calculations by The Wall Street Journal.

Prices had declined month-on-month starting April last year.

Still, the overall gain was feeble, as prices were depressed by continued declines in lower-tier cities. The NBS data showed prices fell in 43 of the 70 cities, mostly small cities.

Prices in second-tier cities were stable. Prices in first-tier cities, however, had much stronger upward momentum. The largest monthly gain occurred in Shenzhen, where new home prices advanced 6.7 percent, the fastest pace since 2011.

The city also saw the largest year-on-year price jump, with a gain of 7.7 percent from a year earlier. It was also the only city among the 70 that saw a higher price compared with a year ago.

Price gains in other major cities beat expectations. New home prices in Beijing and Guangzhou rose 1.4 percent over April. In Shanghai, the rise was 2.6 percent.

Prices of pre-owned housing, which responds more swiftly to changes in sentiment, recorded a larger gain. Shenzhen's prices surged 6.3 percent from April, and in Beijing, the average price rise accelerated to 4.3 percent from 2.1 percent in April.

The market staged a turnaround starting in April as several easing measures to bolster demand took effect. Sales volumes set records in several cities in April and again in May. Last month, residential housing sales surged 30.4 percent month-on-month by value, China Daily's calculations based on NBS data showed. By volume, sales climbed 16.4 percent.

The upswing has continued this month, although mostly in first-tier cities. In Beijing, pre-owned home sales hit 8,974 units in the first half of June, up 19.3 percent from the same period in May and up 251 percent compared with a year earlier, according to Centaline Property Agency.

Nationwide, sales diverged among cities. Sales in first-tier cities in the first half of June rallied 26.7 percent month-on-month, but the gain was only 3.8 percent in second-tier cities. And sales in third-tier cities fell 22.1 percent, Centaline said.

"There is a renewed enthusiasm about buying real estate, which stimulated a rise in both sales and prices. The bullish stock market has generated massive wealth, strengthening a willingness to buy houses. We expected a sustained recovery in the remainder of this year. Momentum in first-tier cities is particularly strong," said Xia Dan, an analyst with Bank of Communications Co.

However, Tom Orlik, chief Asia economist with Bloomberg, said the passthrough from sales rebound to stronger building will be delayed and muted, given the high inventory. He estimated supply has outstripped demand by about 10 million units in the past five years, which suggests investors are holding empty apartments equivalent to about a year of sales.

- O2O Expo focuses on how such businesses benefit people's lives

- Alibaba, Foxconn fund Softbank's robotics company

- Ant Financials secures investment from social security fund

- IMF to decide on yuan's inclusion in currency basket

- Stocks fall for third time in one week

- China's growth will benefit other countries

- China streamlines business registration to encourage startups

- Last traditional dragon boat maker in Chengdu