China's consumer inflation picks up in June

(Xinhua) Updated: 2015-07-09 10:08

|

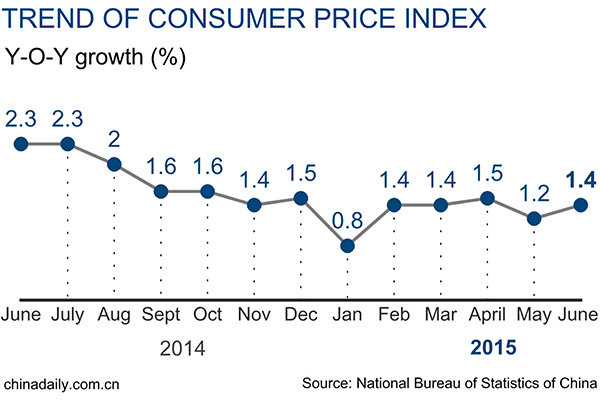

BEIJING - The consumer price index, a main gauge of China's inflation, was up 1.4 percent from one year earlier in June and rose 1.3 percent in the first half of the year, official data showed on Thursday.

Growth in China's consumer price index (CPI), a main gauge of inflation, edged up to 1.4 percent in June, slightly above market forecasts of 1.3 percent and 1.2 percent rise in May.

On a monthly basis, consumer prices in June remained unchanged, compared with a dip of 0.2 percent posted in May, the National Bureau of Statistics (NBS) said on Thursday.

NBS statistician Yu Qiumei attributed the pick-up to a lower comparative base from June last year and higher prices of food, including vegetables and pork.

For the first half of the year, CPI edged up 1.3 percent year on year.

Producer price index, which measures wholesale inflation, slid 4.8 percent year on year in June, the 40th straight month of declines.

The Chinese government aims to keep its consumer inflation at around 3 percent for 2015.

Related story: Positive signs fuel hope of economy bottoming out, by Xinhua

China's economy is likely to stabilize and recover in the latter half of the year as data suggest economic fundamentals are improving.

Multiple economic indicators suggest the worst is over and positive changes are emerging due to pro-growth and reform policies, the National Bureau of Statistics (NBS) said Monday.

The remarks followed Premier Li Keqiang's reassurance earlier this month that continued macroeconomic regulations and a campaign to promote innovation and entrepreneurship would ensure the country hits this year's growth target.

The reaffirmation of confidence came ahead of the release of GDP data for the second quarter on July 15, which analysts predict will slip below 7 percent as the effects of China's pro-growth policies have yet to spread.

UBS chief China economist Wang Tao estimated GDP growth will ease to 6.9 percent in the second quarter as the real economy remains sluggish.

But as the effects of the country's expansionary fiscal policy and monetary easing spread, growth is expected to tick up in the third or fourth quarter.

In addition to four interest rate cuts since November, China has decided to remove its 75-percent loan-to-deposit ratio requirement to give banks more freedom to lend.

The government has also accelerated fiscal spending with the approval of a package of major infrastructure projects and an ambitious plan to speed up improvement of run-down urban areas.

The policies have already produced some changes. Earlier data showed China's manufacturing activity remained in expansion territory for three straight months while growth in the services sector quickened, suggesting continued economic improvement.

Growth of high-tech and consumer products manufacturing continued to beat overall manufacturing, signaling success in economic restructuring, while high energy-consuming industries saw slower growth, according to the data.

The property sector is also warming up. The sector's fortune is considered crucial to the broader economy as it affects a wide range of industries, including steel and cement.

The average price per square meter in a sample of 100 cities rose 0.56 percent month on month to 10,628 yuan ($1,739) in June, according to a survey by the China Index Academy (CIA), an independent research institute.

The gain accelerated from 0.45 percent in May, which was the first rise since January.

Other recovery signs include an increase in power consumption, faster credit growth and higher prices of some raw materials.

"This shows that market demand is bottoming out, and China's economic growth will see mild recovery in the latter half to put it on track to meet this year's growth target of around 7 percent," noted Lian Ping, chief economist at the Bank of Communications.

While recognizing the improving trend, NBS spokesman Sheng Laiyuan cautioned that some improvements are still fragile and tentative. He said the country should remain watchful of downward pressure and make stronger efforts to achieve the annual growth target of around 7 percent for this year.

- 2015 China International Fair for Investment and Trade kicks off in Xiamen

- China's commodity imports robust in Jan-Aug period

- China stocks rebound 2.92%

- 2015 China box office already past 2014 total

- China foreign trade decline widens in August

- Interview: JP Morgan's senior executive bullish on China

- Innovation, development the focus for NZ mayors

- Lives of freelancers