Planting the seeds for future growth

By ZHONG NAN (China Daily) Updated: 2015-07-14 08:17

Yin Jiang'an, general manager of Jinmaoda Furniture Co, has seen timber costs soar in the past few years, sparking a price war among rival companies.

His firm has one of the largest factories in Dalingshan, a major furniture exporting center in Dongguan, South China's Guangdong province.

Specializing in furniture, Jinmaoda employs 1,500 workers. But times are tough as prices for hardwood, such as Brazilian rosewood and Australian blackwood, spiral.

"Many Chinese furniture makers bought large amounts of hardwood for veneer, flooring and decorative products when lumber prices were much lower," Yin said. "This resulted in an oversupply of furniture products, which has since triggered a price war.

"But now that lumber costs are much higher, even after we sell our existing inventories we will still face increased prices when we stock up in new timber imports," he added. "This limited the nation's bargaining power in the global market."

China will need to play a bigger role in influencing the price of timber to prevent costs soaring on the international stage by increasing domestic stockpiles.

A widening supply gap has forced the world's largest wood importer to purchase more timber from Russia, the United States, Canada and New Zealand to meet surging demand.

Imports from countries in Southeast Asia and Africa have also climbed despite tougher regulations to combat smuggled shipments.

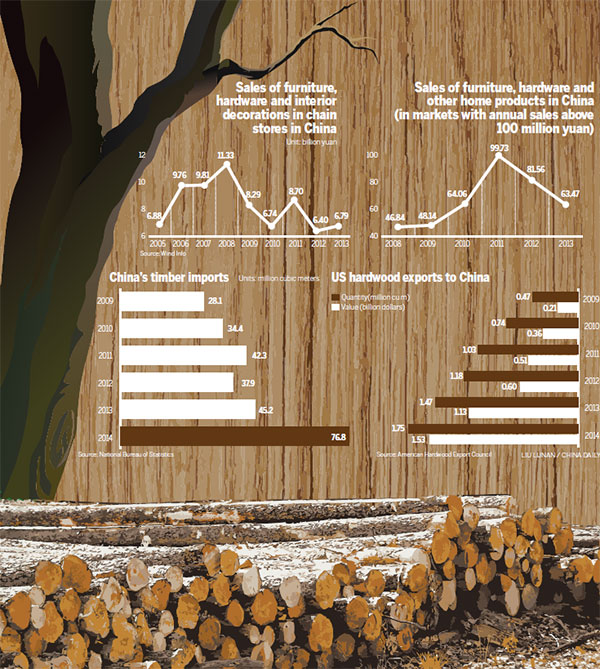

Last year, China's demand for foreign timber hit 76.8 million cubic meters, a 40 percent increase compared to 2013, according to the General Administration of Customs.

Zhang Jianlong, deputy director of the State Forestry Administration, put this down to China's booming construction sector, which is relying on more "green" building materials, and an increase in furniture manufacturing.

By 2020, demand for timber is expected to jump to 800 million cu m.

Naturally, the government is eager to prevent the cost of wood spiraling by cutting imports by 10 percentage points from the current 60 percent level during the next five years.

Forest programs and research and development into new building materials, will help close the gap. "Because of legal and environment reasons, dwindling timber shipments from Brazil, Myanmar, Ghana and Gabon have become an increasingly pressing issue," Zhang said.

"It is therefore important to put together a reliable supply chain."

Helping the furniture industry cope with this changing landscape will be vital. In Dalingshan, 400,000 workers are employed in the sector, but last year exports from the town fell 11 percent to $437 million compared to 2013, the Dongguan Furniture Industrial Association reported.

Apart from increased prices and oversupply, tough new European Union standards have also hit Chinese exports to EU countries.

- 2015 China International Fair for Investment and Trade kicks off in Xiamen

- China's commodity imports robust in Jan-Aug period

- China stocks rebound 2.92%

- 2015 China box office already past 2014 total

- China foreign trade decline widens in August

- Interview: JP Morgan's senior executive bullish on China

- Innovation, development the focus for NZ mayors

- Lives of freelancers