'Earnings shock' jolts big lenders

By Jiang Xueqing (China Daily) Updated: 2015-09-01 07:36

|

|

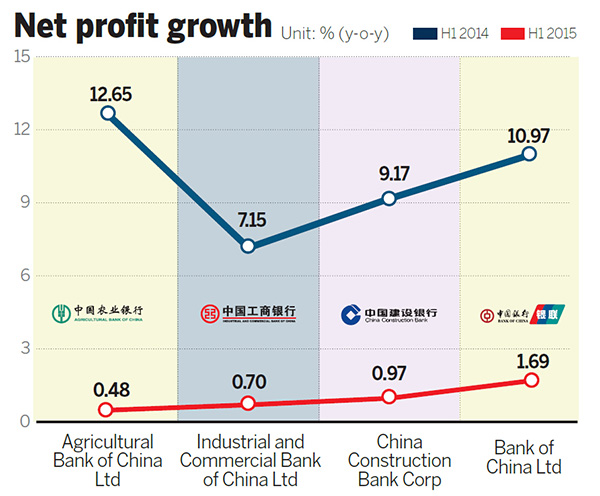

Source: Interim reports of the four major State-owned banks. [Lu Nan/China Daily] |

Researchers said the drop was caused by a series of interest rate cuts amid the economic downturn and the banks' significant increase in loan provisions to guard against bad loans.

Of the four largest State-owned lenders, Agricultural Bank of China Ltd suffered the most notable slowdown in net profit growth-a fall from 12.65 percent a year earlier to 0.48 percent.

Xu Wenbing, a senior manager at Bank of Communications Co Ltd's Financial Research Center, said the central bank has cut interest rates five times since November, which led to shrinking net interest margins for commercial banks.

Agricultural Bank's net interest margin dropped 16 basis points year-on-year to 2.61 percent in the first half of this year.

At the same time, the banks significantly increased provisions for loan losses as nonperforming loans rose rapidly.

Industrial and Commercial Bank of China Ltd recorded an increase of 17.8 billion yuan ($2.79 billion), or 75 percent, in provisions from the previous year. Its new NPLs reached 39 billion yuan, larger than the new NPLs of 30.81 billion yuan for the full-year figure in 2014.

"Because of interest rate cuts and the increase in loan loss provisions, large banks saw a rapid decline in net profit growth. We expect the net profit growth for 2015 to stay at around 1 percent. Some may even post profit declines if they continue to face pressure to cut interest rates," Xu said.

Jiang Jianqing, chairman of ICBC, said the economic restructuring has its costs, part of which is paid by banks.

The string of five interest rate cuts reduced ICBC's profit by more than 27 billion yuan. However, the economy is heading in a positive direction.

- 2015 China International Fair for Investment and Trade kicks off in Xiamen

- China's commodity imports robust in Jan-Aug period

- China stocks rebound 2.92%

- 2015 China box office already past 2014 total

- China foreign trade decline widens in August

- Interview: JP Morgan's senior executive bullish on China

- Innovation, development the focus for NZ mayors

- Lives of freelancers