New strategies needed to boost global economic development

(Xinhua) Updated: 2015-10-12 10:08Commenting on China's GDP growth, Lagarde said the country's slowdown was "predictable and expected."

"There will be bumps on the road as no transition can be done smoothly with no disruption or volatility ... We welcome China's transition process coupled with more market-determined exchange rate fluctuations," she said.

Lagarde's words were backed up by the IMF's Global Policy Agenda, which was released ahead of the meetings.

"In China, fiscal, social security and state-owned enterprise reforms are needed to transition to more domestically-driven growth, which will benefit the global economy over time," it said.

In addition, the China-proposed Belt and Road initiative, or the Silk Road Economic Belt and the 21st Century Maritime Silk Road initiative, and the Asian Infrastructure Investment Bank (AIIB) establishment have both attracted more attention as new solutions for boosting global economic growth.

Meanwhile, the United States, whose economic recovery has largely benefited from the position of the US dollar, a universal money, should bear more global responsibilities and play a bigger role in boosting the world economic growth.

For example, it should work with other developed countries to further broaden public investment to fuel economic growth, so as to provide outside support for developing countries' structural readjustment.

Moreover, export-dependent countries seeing their revenues falling should accelerate reform and explore new areas for growth.

All in all, both China and the United States, as well as other major economies, should strengthen coordination in their macro-policies and stay away from self-serving trade manipulation for a healthier recovery of the world economy.

- Internet courses go through learning curve

- China to implement plan for transparent global tax regime next year

- Central bank to expand relending pilot program

- Evergrowing Bank reports 13.9% rise in profits

- Second China-Russia Expo opens

- Lock-up shares worth 101b yuan to become tradable

- China's forestry tourism booms

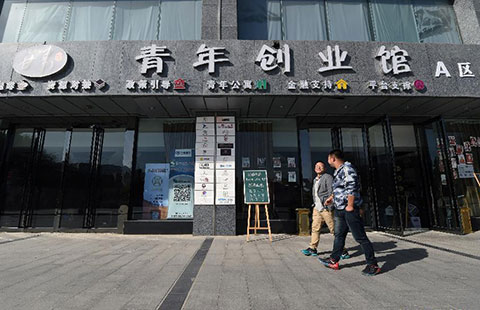

- Beijing's Zhongguancun focuses on serving innovation, start-ups