China Oct producer prices and inflation fall again

(Agencies) Updated: 2015-11-10 11:11

BEIJING - China's consumer inflation moderated even further, while producer prices extended their decline to the 44th straight month, flagging persistent deflationary pressure in the world's second largest economy.

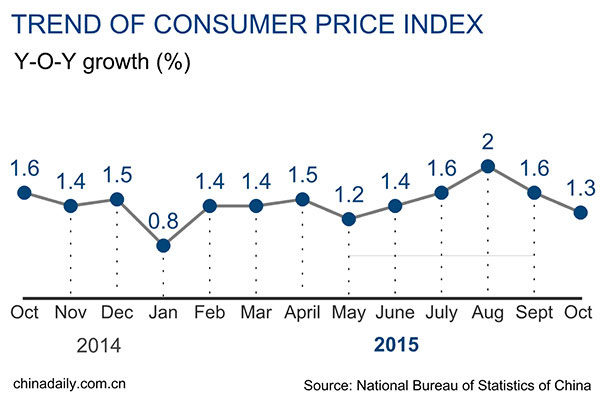

The October consumer price index (CPI) rose 1.3 percent from a year earlier, compared with 1.6 percent in September, National Bureau of Statistics (NBS) data showed on Tuesday. The reading came in below expectations of a 1.5 percent rise according to a Reuters poll of economists.

The producer price index (PPI) fell 5.9 percent in October from a year earlier, equal to the 5.9 percent decline in September and slightly worse than economists' forecasts of a 5.8 percent drop.

The weak inflation print continues an already well-established trend of falling producer prices and tepid consumer price rises, in part a result of sharply lower commodity prices in 2015 but also reflecting slowing demand growth for many goods..

China is already in its biggest easing cycle since the height of the financial crisis, but low inflation means that real interest rates remain high for many firms, especially manufacturers many of whom have already endured several years of falling factory gate prices.

The central bank has cut benchmark interest six times since November last year and repeatedly reduced banks' reserve requirement ratio.

More stimulus is needed to secure Beijing's growth target of no less than 6.5 percent in the next five years, and pave the way for a the transition to more a consumption-led growth model, analysts say.

Trade figures disappointed analyst expectations by a wide margin in October with exports falling 6.9 percent and imports slipping 18.8 percent. Activities in China's factory sector fell for the eight months in October, private and official survey showed, though the reading pointed to a slower pace of contraction.

- Half of companies' overseas businesses making a profit

- Li promises full use of fiscal weapons

- Top 10 R&D importing countries in the world

- Cooling inflation prompts calls for easing policies

- Two-child policy to increase potential economic growth rate

- China hails new taxi regulations

- Japan's investment in China shifting to service and high-end industries

- JD to shut down C2C business