Internet finance is driver for Dalian Wanda's growth

By Jiang Xueqing in Hong Kong (chinadaily.com.cn) Updated: 2016-01-18 16:41

|

|

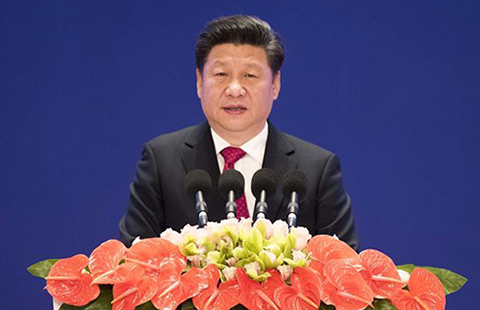

Wang Jianlin, chairman of the company, speaks at the Asian Financial Forum in Hong Kong on Jan 18, 2016. [Photo/IC] |

Dalian Wanda Group Co Ltd, China's largest commercial property company, sees Internet finance as the most important driver for its future development.

The company is to have an initial public offering (IPO) for its Internet finance arm, Wang Jianlin, chairman of the company, said at the Asian Financial Forum in Hong Kong on Monday.

Although he did not reveal a specific time for the IPO or money to be raised, Wang laid out strategic targets for the development of Wanda's Internet finance.

By 2020, the group's Internet finance services will cover 5,000 shopping centers and 700 million to 800 million consumers. It will issue 500 million membership cards that combine multiple functions including applications for retail, catering and entertainment services, loans, credit card services and points earning for rewards.

It will also extend 300 billion yuan ($45.6 billion) of loans online, of which personal lending will reach 200 billion yuan and corporate lending 100 billion yuan.

"The membership cards will account for the largest value of Wanda Group," Wang said.

The company will focus on five major platforms: big data analysis, credit investigation, online lending, mobile payment and membership cards issuance and development.

- More to Wanda's Hollywood foray than meets the eye?

- Dalian Wanda clinches deal for Legendary Entertainment: source

- Wanda dreams big with Guangzhou sports center

- China estimates 400 billion yuan added value in sports industry in 2015

- Chinese billionaire aims to build world's most profitable sports company

- 4 low-cost carriers ally to tap the promising market

- Declining prices spook oilfield equipment makers

- Xi optimistic about China's economic fundamentals

- Full steam ahead for China's global rail projects

- Toys R Us to expand reach with more stores

- Fosun deal could kick-start new era for soccer industry

- Crude shock lands oil majors on a slick

- China gains major win in fastener dispute with EU