Stocks get boost from cut in ratio

By Cai Xiao (China Daily) Updated: 2016-03-02 07:40

Sentiment also helped by hopes of economic reform during 'two sessions'

Stocks rallied on Tuesday, a day after the central bank cut the amount of cash that Chinese banks must hold as reserves, and the upcoming "two sessions" raised hopes of economic reform.A strengthening yuan also overshadowed disappointing manufacturing data.

The benchmark Shanghai Composite Index rose by 1.68 percent to close at 2,733.17 points, heading for its biggest advance in a week.

The Shenzhen Component Index increased 2.47 percent, while the startup index ChiNext climbed by 2.91 percent.

Technology, materials and securities shares led the risers.

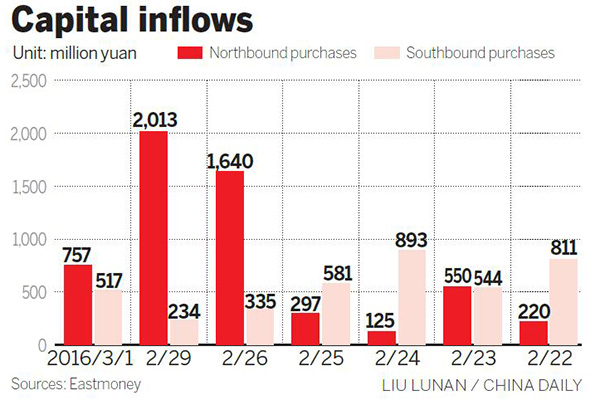

The daily amount of northbound trading through the Shanghai-Hong Kong Stock Connect program totaled 757 million yuan ($115.6 million) on Tuesday.

The required reserve ratio dropped by 0.5 percentage point on Tuesday.

"The easing signal from the RRR reduction will help lift market sentiment," said Gao Ting, head of China strategy with UBS Securities Co.

He added, with the approach of the "two sessions"-the annual meetings of the National People's Congress and the Chinese People's Political Consultative Conference-"market focus will shift to policy signals and supply-side reforms, and investor confidence could gradually recover".

Wendy Liu, chief China strategist at Nomura Securities Co, said the upcoming two sessions will strengthen investor confidence that Beijing is taking action on economic reforms.

Xu Lirong, chief investment officer at Franklin Templeton Sealand Fund Management Co, called the RRR cut a positive factor for the Chinese stock market, adding that levels are already through their worst and that he expected a 10 to 20 percent rebound in the short term.

- Property owners in big cities reluctant to sell

- China's central bank and US Fed officials exchange ideas

- Beijing boasts 2nd largest number of valuable tech startups

- Top 10 richest in Chinese mainland by Hurun list

- China issues guidelines promoting green consumption

- Chinese shares rally on RRR cut

- China monthly box office surpasses North America's

- China completes vehicle reform for central government