Sany expands machinery sales overseas

By Yang Ziman and Wen Xinzheng (China Daily) Updated: 2016-09-02 11:00

|

|

Employees work at a Sany assembly plant in Lingang Industrial Park, near Shanghai. [Photo/Agencies] |

Editor's note: In this ongoing series on the birth and growth of privately owned Chinese companies that are redefining innovation, China Daily profiles Sany, the largest machinery manufacturer by revenue in China, which is shifting machinery sales overseas.

China's Belt and Road Initiative offers promising opportunities for Sany Group to expand its global market, said president of Sany, the largest machinery manufacturer by revenue in China.

"Sany has established a Belt and Road office to push forward with the export of machinery for wind power, minerals, port and residential housing construction, and oil and gas exploitation," said Xiang Wenbo, president of Sany, which is based in Changsha, Hunan province.

Sany relies less on the domestic market and has a larger footprint overseas, he said.

Before the financial crisis, more than 90 percent of Sany's sales were in China. In 2015, the company's overseas revenue stood at 10 billion yuan ($1.51 billion), accounting for 44.2 percent of its total revenue. For example, its overseas sales of excavators increased by 90 percent in 2015 year-on-year.

The company has built sales networks in more than 70 countries and regions around the world, with exports to more than 100 countries and regions. It has more than 4,000 employees overseas, with factories in India, the United States, Germany, Brazil, and Indonesia.

"Road construction in Pakistan has brought contracts worth more than 100 million yuan to Sany. Construction by Chinese companies in Africa has brought Sany's machines to that continent. Our offices overseas have provided reliable after-sales service to customers," said Xiang.

In 2012, Sany purchased German company Putzmeister Holding GmbH, a leading global concrete machinery manufacturer for 360 million euros ($400.7 million).

"Putzmeister has factories in Turkey, Belgium, Spain and Russia. It compliments our manufacturing capacity overseas," said Xiang.

According to a report by ocn.com.cn, a Shenzhen-based consulting agency, shrinking domestic demand, overcapacity and rising operating costs have put a limit on machinery manufacturing in China. The overseas market offers a new growth point for the industry. But, Chinese companies should not be too optimistic because, unlike the Chinese government's bailout investment, the demand overseas is sporadic.

The annual growth rates of machinery industry in China have been more than 10 percent every year in the past few years. But, Xiang said, such high rates were abnormal. As the investment slows down, the industry is going to go through a reshuffle.

More than 100 excavator manufacturers emerged just a few years ago. Now only 20 of them are still operating.

"Our revenue at one point was only one tenth of the highest level we had ever achieved. We have cut our employees down from 70,000 to 30,000. It has been quite a painful period," said Xiang.

Now, Sany has survived the competition. In 2011, its excavator revenue grew by only 11 percent year-on-year. The growth rate reached 20 percent year-on-year in 2015.

In the first half of this year, Sany's concrete machinery registered a revenue of 5 billion yuan, number one of its kind in the world. Its exactor revenue stood at 3.4 billion yuan, number one in the Chinese domestic market.

- Shanghai Electric Power bids on Pakistani utility

- New York-based Foot Locker looks to move beyond sneakers

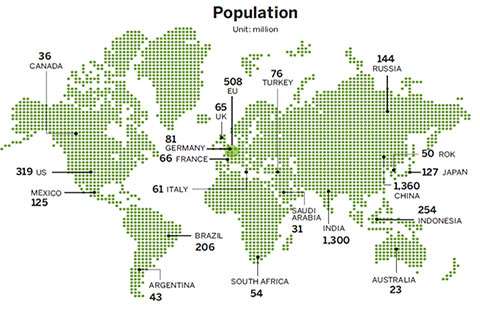

- China, other G20 members contribute to global financial governance

- World leaders arrive in Hangzhou for G20 summit

- China growing at sustainable rates good for global economy: Lagarde

- Scenery of White Horse Lake in Hangzhou

- Local residents make silk scroll to greet G20 summit

- Govt to promote venture capital