Silk Road Bond to meet financing needs of countries on Belt and Road routes: expert

(Xinhua) Updated: 2016-09-08 16:39HONG KONG - Issuing Silk Road Bond (SRB) will be an internationally recognized funding method to bring benefits to countries along the Belt and Road routes, Dagong Global Credit Rating (Dagong) chairman said here on Thursday.

Guan Jianzhong made the remarks at the "Belt and Road Summit - Financing Through Silk Road Bond," which was co-organized by the International Capital Market Association (ICMA) and Dagong.

Proposed by China in 2013, the Belt and Road Initiative refers to the Silk Road Economic Belt that links China with Europe through Central and Western Asia by inland routes, and the 21st Century Maritime Silk Road connecting China with other Asian countries, Africa and Europe by sea routes.

According to Guan, the ability for the countries along the routes to raise foreign funds to finance their infrastructure projects and domestic consumption is vital to the success of their economic growth.

There are great market opportunities along the Belt and Road routes, he said.

Many countries along the routes lack the capacity to undertake major infrastructure projects on their own, while the SRB can be an interconnection between those investment opportunities and the international financial market, according to Guan.

A series of related bond products are expected to be developed in line with different situations in each country, such as infrastructure bond, trade bond, industrial capacity operation bond and technology innovation bond, he said.

The one-day summit focused on economic growth along the Belt and Road routes, financing needs and how to bridge gap in current systems.

Following the summit, ICMA intends to work with key stakeholders including major Chinese and international banks, law firms, audit firms and credit rating agencies to assess the feasibility of developing the SRB.

- Belt and Road initiative to benefit Europe's trade: EU think-tank

- China's Belt and Road Initiative to stimulate Asian, global economic growth: Bangladesh economist

- Belt and Road Initiative supports firm's sales

- Belt and Road Initiative for global benefit

- China training neurosurgeons as part of Belt and Road Initiative

- Real estate rules to differ more between cities

- First annual Drone Festival in Paris

- China's August exports up 5.9%, imports up 10.8%

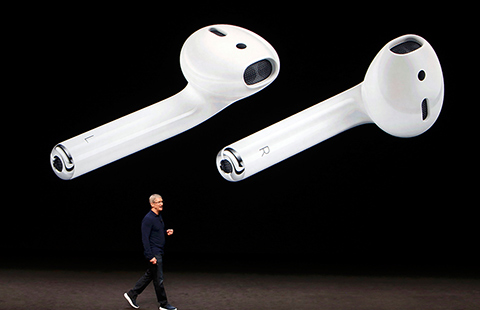

- New iPhone to boost Apple's sales in China

- Giant digital billboards light up landscape during G20 Hangzhou Summit

- World Bank official hails China for ratifying Paris climate deal

- China's economic transition presents investment opportunities: foreign

- China National Gold Group's purchase of 82 pct stake in Jinfeng completes