Splitting up to move on up

By Wu Yiyao in Shanghai (China Daily) Updated: 2016-09-12 06:53

|

|

Potential homebuyers examine a property project model in Yichang, Hubei province, Aug 23, 2016. [Photo/China Daily] |

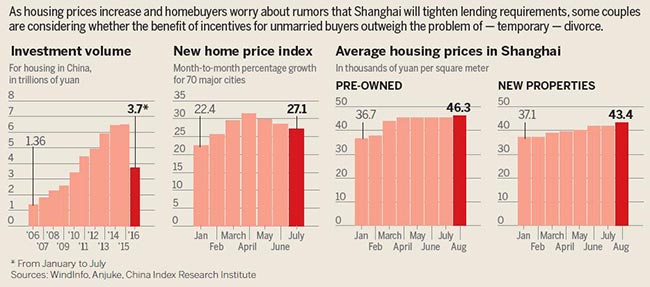

Couples in Beijing and Shanghai are considering divorce to buy a new home as rumors stoke anxiety over rule changes for property purchases

Beijing civil servant Li Zhen and his wife face a difficult decision: The couple may need to divorce to realize their dream of a bigger and nicer home.

If they do not split, at least legally, they may have to pay up to 1 million yuan ($150,000) in income tax if they sell either of their two small apartments, according to the current real estate policy. This would make their plan to upgrade financially impossible.

But if they divorce, with each taking ownership of one property, they could be spared the tax.

Time appears to be against them, too, as the market is rife with speculation that Chinese banks could tighten lending requirements for potential homebuyers, such as demanding higher down payments, from which unmarried people would be exempt.

"I know that if people work out what we're doing they'll despise me and even question my morality," Li said. "But what can we do?"

The Li family is not alone. Many happily married couples in Beijing and Shanghai who have seen house prices soar are facing a similar dilemma.

In Beijing, families with more than one property are required to pay a 20 percent tax on any profit made from a real estate deal. According to the regulations, families can own a maximum of two apartments.

|

|

Potential homebuyers read advertisements at a property expo in Beijing in April. [Photo/China Daily] |

Some couples in the capital have also opted to divorce before selling to avoid the tax.

In Shanghai, civil affairs offices have been overwhelmed by couples who want to split up due to concerns over changes to the rules. Their anxiety was compounded on Aug 24 with a rumor that the city was to block divorcees from buying property with a 30 percent down payment within a year of their breakup.

The strategy is to get divorced in the morning, buy a property as a single person (with a down payment of just 30 percent of the full price if it's their first home) in the afternoon, and remarry the next day.

It's a method often used by couples who want a new house but don't want to meet the higher down payment requirement for a second home, which is at least 50 percent.

On Aug 25, the Shanghai housing authority took to social media to dismiss the rumor. Yet that did not prevent more than 130 couples applying for a divorce that day at just one of the city's civil affairs offices, double the daily average, China Economy Weekly reported.

The authority dismissed similar rumors twice in a week in early September, saying that policymakers were not considering changing the polices regarding property purchases.

By Thursday, five social media accounts had been closed permanently for spreading the rumors, with 13 more suspended for about a month. The next day, seven real estate agents were detained on allegations of starting rumors to boost their business.

"People would rather believe the rumor than risk becoming ineligible to buy a home with the current down payment requirement if a limit is placed on property purchases," said Ma Junjie, an agent for Homelink in Shanghai. "It's indeed herd mentality, but for some, to be one of the herd is better than being left behind."

Industry insiders believe the gap between supply and demand is the key factor for the rising property prices.

Gao Jianfeng, a property market analyst at Numora Securities, also said that limits on home purchases only work on a temporary basis.

"In such situations, unless land supply rises significantly, measures to curb soaring home prices won't be very effective," he said.

The residential property market in China is diverging, with some cities struggling to reduce huge inventories and others facing overheated markets.

Albert Lau, CEO of Savills China, said in an interview this year that for lower-tier cities facing pressure to reduce inventory, one key task is to transform the local economy and make the city more attractive to potential buyers.

If a city does not provide enough employment opportunities or attract people to settle there, it won't generate the demand for housing, he said.

- Beautiful, smart robots shine at expo in Nanjing

- China, US still hopeful of wrapping up investment talks under Obama administration

- China-Thailand rail project likely to break ground this year: Thai deputy PM

- Alibaba to expand investment in ASEAN

- Steel companies swing back to profit

- A homebuyer's story: Long wait, then panic

- New railway marks 20,000-km record

- East-west link dramatically cuts travel time for commuters