Asian regional financial cooperation to bring new growth momentum

(Xinhua) Updated: 2016-10-22 10:36BEIJING - Financial cooperation will bring new growth momentum to Asian countries, given that although there have been visible outcomes in this field, the scale is limited, according to specialists.

"The low-hanging fruit has already been picked in Asian regional cooperation after years of development," said China's Vice Finance Minister Shi Yaobin at a seminar held in Beijing Friday.

Speaking at the same event, Waikei Raphael Lam, IMF Resident Representative for China, said that there was great potential for regional financial cooperation for Asia, and suggested enhanced Asian capital market integration and risk control cooperation.

In recent years, the monetary policies of major economies have taken diverging paths, the capital markets have become more volatile, and instability in the financial system has increased, attendees at the seminar agreed.

In responding to potential risks and challenges at the regional level, the accessibility and effectiveness of the Chiang Mai Initiative Multilateralization (CMIM) should be further enhanced, and the functions of the Association of Southeast Asian Nations Plus Three (ASEAN+3) Macroeconomic Research Office (AMRO) in regional macroeconomic monitoring, crisis management, policy dialogue and technical assistance should be strengthened.

At the national level, financial regulation reform should be effectively pushed forward to monitor and manage short-term capital flows, which will help guard against financial risks.

Experts hope that international organizations and national regulatory authorities within the region could improve the way in which they monitor the regional macro economy, bringing international organizations such as AMRO and IMF into full play, and building up a regional financial safety net in accordance with Asian practice, thereby, better safeguarding financial stability in Asia.

"The Asian Infrastructure Investment Bank (AIIB) will launch more projects in December this year to promote regional interconnectivity, as pushing forward regional cooperation and solving problems in regional development is one of the bank's priority tasks," said AIIB Vice President and Chief Administration Officer Luky Eko Wuryanto at the seminar.

While Asia is the world's most vigorous region, its infrastructure remains relatively poor and there is huge demand for investment in this regard.

Multilateral development banks (MDBs) such as the World Bank and the Asian Development Bank have contributed tremendously to regional infrastructure development, henceforth, the AIIB and the New Development Bank will play a supplementary role, according to the experts.

To better meet the investment demands of regional infrastructure and connectivity, what regional connectivity in Asia lacks -- rather than capital -- is a more diversified and inclusive investment and financing mechanism that brings together existing and potential resources, they said.

Experts advised the new and existing MDBs, as well as the public and private sectors to boost collaboration in order to build diversified financing mechanisms, boost regional connectivity, and lay a solid foundation for mid-to-long term economic development in Asia.

The seminar, which carried the theme "Deepening Asian Economic and Financial Cooperation, Promoting Regional Integrated Development," was hosted by the International Economics and Finance Institute under the Ministry of Finance, China.

Government officials, NGO delegates, bank governors and economists from China, Japan, Australia, Korea, Indonesia and Singapore, among others, attended the seminar Friday.

The Asian financial crisis in 1997 was a wake-up call for many countries -- as they realized there was a real need for regional financial cooperation. These endeavors have achieved considerable results. The accomplishments have been largely the work of various regional financial forums, including ASEAN+3.

- Intelligent vehicle innovation club in NE China

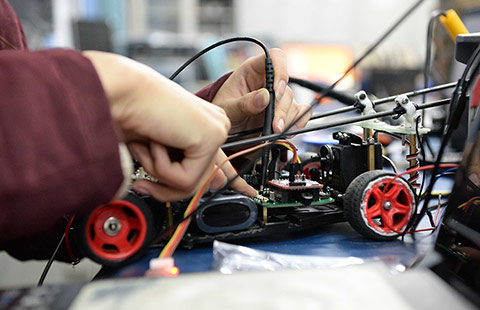

- 'Core tech needed' for robotics

- Housing prices begin to stabilize in key cities

- Li calls for prompt talks on US treaty

- Major capital flight in Q4 called unlikely

- Chinese group mulls building steel plant in the Philippines

- HK company to buy soccer's Hull City

- Walmart in $50 million deal with New Dada