Containing losses, sailing together

|

|

A worker walks past a container ship at Mundra Port in the western Indian state of Gujarat in this file photo. [Photo / Agencies] |

Trade woes are pushing container shipping firms into new alliances, reshaping the troubled industry

As global trade flows shrank over the last five years, red ink blotted container shipping lines' financial results, pushing them into alliances that are reshaping the market, creating new buzz phrases like resource integration, big size, operational efficiencies and route specialization.

Hanjin Shipping Co, South Korea's largest ocean shipping company by fleet size, launched bankruptcy proceedings following years of losses in September. This has rocked the global trading system, which includes foreign governments. Creditors seized ships, ports refused to handle Hanjin-linked cargo.

"Container shipping firms' alliances have become critical as the global shipping industry has been confronted with both cumbersome overcapacity and volume slowdowns," said Wang Haimin, managing director of COSCO Shipping Lines Co Ltd, the container unit of China COSCO Shipping Corp Ltd, a State-owned enterprise and the country's biggest shipping company by fleet size.

Despite the current good demand globally, Wang said the container shipping sector may continue to suffer in the short term as freight rates have dropped quickly in recent years, prompting a wave of consolidation in the container industry.

"Under an alliance or partnership, members can share port calls, networks and ships. Therefore, they can cut costs. This can result in a large amount of financial savings each year," said Wang.

Ocean Alliance, formed by mainland's China COSCO Shipping, France's CMA CGM SA, Taiwan-based Evergreen Line and Hong Kong's Orient Overseas Container Line, announced earlier this month that they will deploy 350 container vessels to the global market to further challenge 2M and the Alliance.

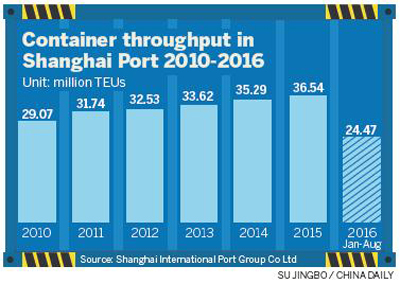

With a total carrying capacity of 3.5 million twenty-foot equivalent units or TEUs, Ocean Alliance will be able to provide a service coverage on a number of trade lanes including 20 trans-Pacific and six Asia-Europe shipping services.

For its part, 2M, formed by Denmark's Maersk Line and Switzerland's Mediterranean Shipping Co SA, started its operations in 2015, and controls more than 2.1 million TEUs, and manages more than 200 vessels.

With each firm staring at financial losses due to overcapacity, three major Japanese container shipping lines said they plan to merge their shipping and overseas terminal operations.

Mitsui OSK Lines, Nippon Yusen KK and K Line plan to form a joint venture to combine their shipping operations. They are also merging terminal management businesses outside Japan. They announced their plans before the Ocean Alliance released its initial five-year plan earlier this month.

Following the move by Ocean Alliance, another partnership, simply called the "Alliance", comprising firms in Europe and Asia, came into being on Nov 8. It has industry majors such as NYK Lines, Mitsui OSK Lines, Hapag-Lloyd AG, United Arab Shipping Co, Kawasaki Kisen Kaisha Ltd and Yang Ming Marine Transport Corp. The Alliance will launch joint operations from April.

Under the plan, the six shipping companies will offer 31 services on the main East-West trade lanes using their 240 ships, covering more than 75 ports.

With multiple alliances in place, the industry's focus is now on service quality and schedule reliability, said Lee Mong-jye, president of Evergreen Marine Corp (Taiwan) Ltd, a member of the Ocean Alliance.

|

|

A man works at a container area at the Yangshan Deep Water Port, south of Shanghai in this file photo. [Photo / Agenices] |

The Ocean Alliance will continue to work closely with the authorities concerned to ensure full compliance with applicable laws and regulations, and secure the necessary regulatory approvals for the alliance to commence operations from April.

Rodolphe Saade, vice-chairman of CMA CGM, said member companies of the Ocean Alliance will have an attractive selection of frequent departures and direct calls to meet their supply chain needs, including access to a vast network with the largest number of sailings and port rotations connecting markets in Asia, Europe and the United States.

CMA CGM, a key driver in the alliance, will deploy 35 percent of container ships within the alliance's service network in the initial stage.

The French company will also speed up plans to offer a wider range of services in China because more Chinese companies are keen to move to emerging markets to benefit from booming bilateral trade, preferential trade tariffs and investment opportunities.

Huang Shengqiang, director of the General Administration of Customs' port management office, said the shipping market in China will continue to grow, and one of the most important changes is the composition of its foreign trade.

"Growth in trade with mature markets in the United States and the European Union is modest, while trade with new markets in countries along the Belt and Road Initiative is surging fast," he said.

Eager to further enhance its earnings ability, China COSCO Shipping will continue to diversify its business operations, said Xu Lirong, the group's chairman.

The new moves will likely continue to strengthen its operations from Chinese ports to Europe via the Arctic Northeast Passage by specialized cargo ships. They will also enable digitalization technologies and help develop overseas port facilities such as Piraeus Port in Greece, optimize their resources and create new market growth points, especially in the port service business in overseas markets.

In terms of developing the container shipping business, China COSCO Shipping will raise the operational capacity of TEUs to over 2 million by the end of 2018, to scramble more market share from its three European rivals on East-West and South-North routes.

The Chinese company is considering buying a number of container terminal assets of the troubled Hanjin Shipping Co. It has already agreed to spend $738 million on a new port in Abu Dhabi in the United Arab Emirates.