Global manufacturing giants back China's industrial evolution

BEIJING - There is a factory in Southwest China's Chengdu city, which, should you want to visit, has a one month waiting list.

The attraction? A successful realization of China's ambitious industrial evolution plan "Made in China 2025."

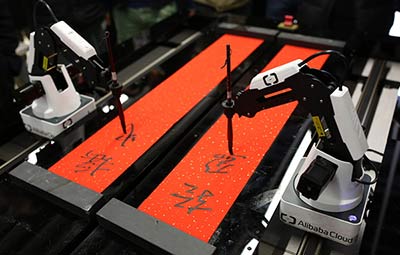

Siemens Electronic Works Chengdu is the the German manufacturer's first overseas model digital plant, featuring machines and products communicating with each other in real time and automated processes. The result: exceptional levels of productivity and quality.

Siemens decided last year to increase its total investment into the Chinese endeavor to over one billion yuan ($145 million) by 2019, a move which will be positive for the wider Chinese manufacturing chain.

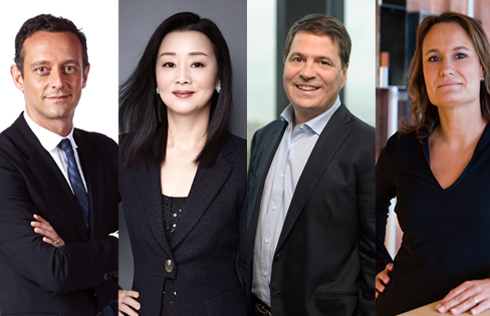

China's goal is for "Made in China" products to be synonymous with innovation and quality by 2025, and it deserves the greatest respect for aiming to complete this transformation by 2049, Joe Kaeser, president and CEO of Siemens, said during the China Development Forum (CDF) 2017.

China's government understands that multinational companies have the potential to play a vital role in the renewal of its economy, but multinationals must also understand that China needs reliable partners, partners who think long term and do not sidestep the challenges ahead, Joe pointed out.

Many foreign manufacturers rushed to open factories in China, to capitalize on the cost effectiveness of "Made-in-China." However, now they are exploring smart manufacturing as the nation transitions from the world's factory to world laboratory.

China will improve policies designed to turn China into a manufacturer of quality, and adopt a variety of supportive measures related to technological upgrading, the government work report for 2017 pointed out.

The Made in China 2025 blueprint was introduced in May 2015, listing several tasks for high-tech manufacturing, including boosting innovation, fostering Chinese brands and service-oriented manufacturing.

In early March, a lengthy report from the European Union (EU) Chamber of Commerce claimed that China's support for high-tech manufacturing would lead to lesser treatment for foreign companies, while allowing government-subsidized homegrown players to compete unfairly.

"The strategy and its related policies are applicable to all businesses in China -- domestic or foreign," Miao Wei, minister of industry and information technology, said at a press conference on the sidelines of the just-concluded annual parliamentary session.

To boost domestic manufacturing, the EU, the United States and Germany have all released similar plans in recent years, Miao said, hoping for more bilateral and multilateral exchanges and cooperation in the area.

The world's second largest economy is transforming from "Made in China" to "Made by China." Numerous measures have been rolled out to digitalize and modernize, which will result in many opportunities, especially for European firms, wrote Charles-Edouard Bouee, CEO of international consulting firm Roland Berger.

Companies should focus on opportunities afforded by the dynamic Chinese market, instead of thinking about taking protectionist moves, Charles added.

China's manufacturing sector is still in the medium stage of industrial modernization, with big differences in automation and digital capabilities among different sectors, regions and companies, leading to different market demands, according to a report released by CDF organizer the Development Research Center of the State Council and Bosch Group.

This calls for bespoke solutions, where we can offer expertise. China is Bosch's largest market outside Europe and cooperation is win-win in nature, because we can also get insights and ideas from our Chinese partners, according to Werner Struth, board member of Bosch Group.

With China well on track to boost its global competitiveness through "Made in China 2025," the widespread application of digital technology could further accelerate progress in energy efficiency and productivity, according to ABB CEO, Ulrich Spiesshofer.

Few countries are better positioned than China to embrace the digital revolution with the world's most Internet users, largest digital retail market and most machine-to-machine mobile connections, Ulrich added.

The challenge is to integrate Chinese enterprises into the digital economy by connecting their robots, machines and plants to the industrial Internet and we could provide such information as well as digital know-how, Ulrich said.