Profits of central SOEs surge 18%

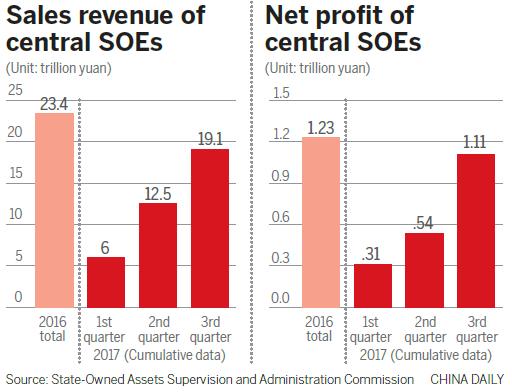

China's State-owned enterprises under central government administration posted a record high net profit of 1.11 trillion yuan ($166.94 billion) from January to September, thanks to more supply-side reforms, reducing the asset-liability ratio requirement and adding curbs on capital outflow.

The nine-month profits represent a year-on-year growth of 18.4 percent, with double-digit growth each month. Among the 98 central SOEs monitored, profits of 56 grew by more than 10 percent and 31 surged by more than 20 percent, the country's top regulator of State-owned enterprises said on Thursday.

Shen Ying, chief accountant of the State-owned Assets Supervision and Administration Commission, said central SOEs are fostering new growth engines by expanding their footprints in strategic new industries and high-tech sectors, such as digital and green economies, artificial intelligence and new energy vehicles.

The central SOEs have invested 1.7 trillion yuan into research and development so far this year, accounting for one-quarter of the country's total.

The total revenue of central SOEs amounted to 19.1 trillion yuan in the first nine months of 2017, up 15.4 percent year-on-year.

The government's goal for central SOEs of cutting 5.95 million metric tons of iron and steel overcapacity has been achieved ahead of schedule, while 23.88 million metric tons of coal overcapacity has been cut.

"A total of 2,041 'zombie companies' from 81 central SOEs have taken a turn for the better in their profits in the first half of this year. Their loss has been reduced by 88.5 billion yuan, compared with the same period of 2015," Shen said.

"Zombie companies" are economically unviable businesses, usually in industries with severe overcapacity, kept alive only with aid from the government and banks.

Shen said the government welcomes companies of all ownership types, as well as foreign companies, to participate in China's SOEs mixed-ownership reforms.

The commission is working on the third batch of SOE mixed-ownership reform pilot projects.

Up to now, 19 central SOEs in two batches have undergone mixed-ownership reforms in areas of power generation, oil and gas, railway and telecommunications. The number of central SOEs also has been reduced from 102 in July to 98 this month.

"China is resorting to SOE mergers and acquisitions to create more global powerhouses with competitive edge and to further the supply-side structural reform," said Yu Xubo, president of COFCO Corp, the country's biggest agricultural products supplier by revenue.

The group plans to see 60 percent of its revenue contributed by overseas markets by 2020 and control up to 50 million metric tons of foreign grain resources to ensure China's food security.