ZRobot eyes risk-evaluation services

E-commerce player JD.com teams up with a US financial-tech company to boost consumer credit

JD Finance, the online-finance arm of JD.com Inc, China's second-largest e-commerce player, has launched the joint venture ZRobot, with US-based financial technology company ZestFinance to provide data-technology services to the financial industry and boost the development of consumer credit in China.The joint venture will offer data value-added and technology-application services, including data modeling, credit rating, asset valuation, fraud identification and precision marketing for banking, auto finance, consumer finance and small-loan companies, said Qiao Yang, chief executive officer of ZRobot.

ZRobot, which combines JD.com's customer database with ZestFinance's machine-learning technology, can provide credit-risk evaluation services to companies in China.

Xu Ling, vice-president of JD Finance, said: "Most of the data value hasn't been fully exploited from the aspect of applications. In particular, there is a shortage of data-technology providers with core competitiveness in China."

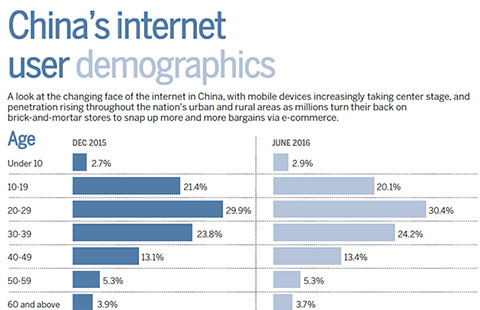

Meanwhile, China's consumer-credit market will maintain a 20 percent annual growth between 2014 and 2017. The market will be worth 27 trillion yuan ($3.94 trillion) in 2017, according to Beijing-based iResearch Consulting Group.

Qiao said ZRobot's service is expected to expand into more financial institutions and other companies in the future to evaluate credit risk.

Mike Armstrong, president of ZestFinance, which uses machine learning to transform vast amounts of complex data into credit scores, said there is a huge potential in China's data-technology market. It aims to bring in new data-technology solutions to improve credit-scoring decisions in China.

Li Chao, an analyst from iResearch, said: "It is a trend for internet companies to tap into the traditional financial field to provide consumer-credit services and help financial institutions prevent and control risks."

However, Li added that the technology that uses big data and artificial intelligence to assess credit risk is not mature and said there are still doubts about the accuracy of the data. Moreover, the data collected from JD's consumer database was not complete and may not properly reflect user behavior, he said.

Meanwhile, JD Finance has said that as a financial-technology company, it is devoted to the development of big data, machine learning and artificial intelligence, to optimize professional efficiency at a lower cost. It also said that it would build an efficient platform based on data and technology and share it with traditional financing institutions, benefiting its customers.

ZRobot is not the first instance in which ZestFinance has worked with Chinese internet giants. In July, it received a strategic investment from Baidu Inc to apply its underwriting technology to Baidu's search, location and payment data to improve credit-scoring decisions in China.