Overseas investors eye Chinese property

By Hu Yuanyuan (China Daily) Updated: 2013-03-25 09:05Stabilized modern warehouses offer compelling entry prices and secure income in many countries, with China at the top end of expected returns. In addition, the development of modern logistics facilities in select regions is very attractive.

"These projects will benefit from infrastructure investment and a steady efficiency drive within the nation's logistics network," said Jacques Gordon, international director of LaSalle.

For Henry Sim, executive director of Industrial & Logistics Services at CBRE, there are several deals about business parks in the pipeline, involving international real estate funds.

"Although there are not many lucrative business park projects at the moment, I believe more opportunities will pop up in the coming two to three years along with China's quickened urbanization process," said Sim.

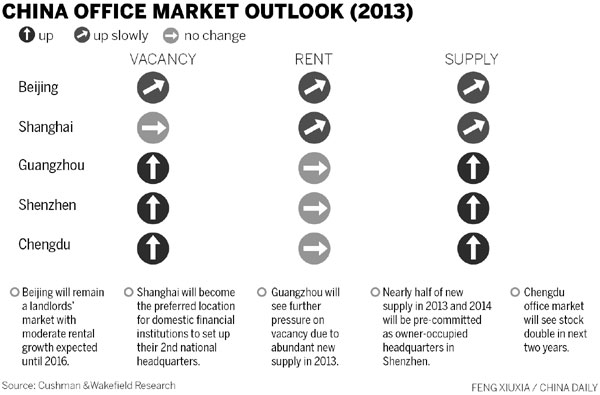

As the grade A and grade B office rental gap widens, grade B offices at core locations in first-tier cities offer upgrading potential through asset and tenancy improvements, LaSalle's research note showed.

Hotels are considered good investments because the best opportunities are in assets that provide stable, core-like returns but are not traditionally perceived as core.

"In hotels, repositioning mismanaged domestic brand hotels in China should yield fairly good returns," said Paul Guest, regional head of research and strategy at LaSalle Asia-Pacific.

Retail remains compelling, although location is vital and deal flow limited. Prime retail in select first- and second-tier cities in China is among areas to watch.

huyuanyuan@chinadaily.com.cn

- Commercial property sales spike in capital

- Beijing commercial property transactions surge

- Shanghai's commercial property sector to see big deals this year

- Measures on HK commercial properties if necessary

- Private investors turn to commercial property sector for opportunities

- Investors refocus on commercial property

- Banks warned of risks in commercial property

- US expert positive about China's commercial property market