Morgan Stanley forecasts 8.2% China economic growth

(Xinhua) Updated: 2013-05-13 20:54"Especially we are expecting more policy stimulus coming from the urbanization initiatives at the end of the year," said Qiao.

Besides, the first quarter data was understandable due to some temporary shocks such as late Lunar New Year and the leap year, and biased by statistical sampling changes, Qiao said. In addition, the adverse impact of the recent banking regulation and property policy tightening measures on liquidity and real estate investment will likely remain limited.

Qiao also mentioned that the 8.2 percent expectation may not be achieved due to some factors. First, compared to a year ago, top decision makers of China now have a higher tolerance level for lower growth, which implies limited room for policy easing in the near term. Moreover, exchange rate, energy price and income distribution reforms the government plans to roll out will likely push up production costs in China further and add cyclical headwinds to the recovery.

However, Qiao still perceived that the achievement of the target is not impossible. "To sum up, we are keeping our real GDP growth forecast of 8.2 percent this year, but not without risk."

- China investigates more online sales, service cases

- China leather exports decline 11.3% in 2016

- Shanghai cements leading role in global trade and investment

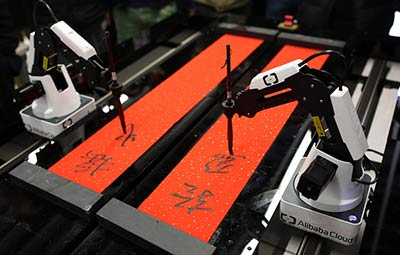

- 'Internet Plus' to fuel brand-building for Chinese agricultural products

- A new cycle emerges with technology

- China consumer confidence drops in March

- China raises retail fuel prices for third time this year

- Chinese airlines see faster passenger growth in March