Performance of investment bankers in H1

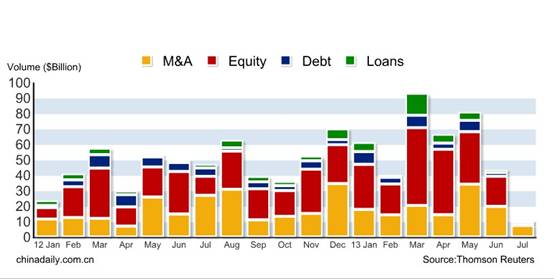

(chinadaily.com.cn) Updated: 2013-07-24 17:09Despite the slowdown of the economy in China, the investment banking sector saw a 50 percent annual growth in the first half of 2013, reaching $384.9 billion in total transaction volume, according data from Thomson Reuters.

Among the four primary businesses of investment banks, only equity transaction saw decreased transaction volume, from $34.7 billion to $34.3 billion. M&A transaction volume increased $37.1 billion, from $83.6 billion to $120.8 billion; debt transaction volume increased $76 billion, to $195.3 billion.

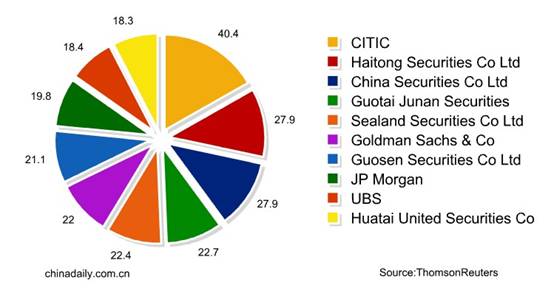

In the first half of the year, CITIC topped the domestic equity underwriting fee ranking, with $40.4 million, representing 6.7 percent of the total market, followed by Haitong Securities Co Ltd and China Securities Co Ltd, with $27.9 million each. Goldman Sachs & Co was the highest ranking foreign investment bank, as it made $22 million in the first half.

- China 'incredibly innovative' in many areas: Apple CEO

- City official: Guangzhou further committed to opening-up

- Jack Ma: Globalization backed by technology will cut inequality

- HNA confirms interest in ASEAN's infrastructure investment

- Comments on Xi's letter to 2017 Fortune Global Forum

- China to create more opportunities for the world: Xi

- US tax cuts impact on China two-sided: economists

- Chinese enterprises job fair to be held in Sri Lanka