ODI set to become more diverse

By Bao Chang and Li Jiabao (China Daily) Updated: 2013-10-16 07:05

Chinese outbound investment will become more diverse in both target markets and fields in the coming year, according to a report released by global consulting firm Ernst & Young on Tuesday.

Going global is necessary for the sustainable development of Chinese companies, said the report, titled China Outbound Investment Trends and Prospects.

The firm forecast economic growth of 8 percent in 2014.

"As China's domestic economy reflects a slight recovery, Chinese capital inflows to developed and developing economies will increase simultaneously next year," said Fabian Wong, a partner in E&Y's China overseas investment department. Wong is in charge of businesses in the European, Middle East, Indian and African markets.

For the first eight months, China's non-financial overseas direct investment increased 18.5 percent year-on-year to $56.5 billion, according to the Ministry of Commerce.

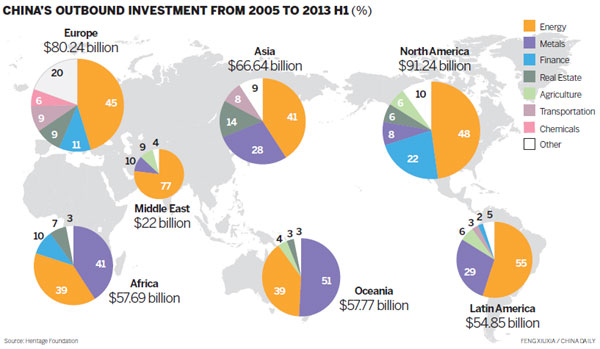

North America, Europe and Asia were the top destinations for China's outbound investment in the first half, the E&Y report shows.

Wong said that Chinese investors continue to reaffirm their interest in the European markets this year. That's especially true of the nation's State-owned enterprises, which have become the driving force in investment. Private-sector companies also have a strong appetite for fast-appreciating assets in the region, but they lack a clear focus in terms of strategy and execution.

Emerging economies in Europe such as Turkey are gradually becoming new investing destinations for Chinese companies, Wong said.

Australia is another attractive market for Chinese investors, with private-sector companies taking a more active role in the market, the report said.

- China 'incredibly innovative' in many areas: Apple CEO

- City official: Guangzhou further committed to opening-up

- Jack Ma: Globalization backed by technology will cut inequality

- HNA confirms interest in ASEAN's infrastructure investment

- Comments on Xi's letter to 2017 Fortune Global Forum

- China to create more opportunities for the world: Xi

- US tax cuts impact on China two-sided: economists

- Chinese enterprises job fair to be held in Sri Lanka