Experts decipher latest growth numbers

Updated: 2014-07-17 11:25 (China Daily)

The growth, which is at par with the first-quarter reading, has been achieved against the backdrop of the country's ongoing economic restructuring - which has had an inevitable adverse effect on growth - and its refusal to rely on large-scale stimulus programs to generate growth. In other words, the country has made a successful first step in shaking off the old growth pattern built on easy monetary expansion and unrestrained stimulus. >>> Read More ----- Xin Zhiming senior writer at China Daily Overall, first-half data were better than expected. The recovery has been supported by investment in infrastructure construction and boosted by targeted stimulus and pro-growth monetary policies since May. While sequential growth is expected to maintain strong momentum, a high base of comparison may impact year-on-year growth in the third quarter. We forecast GDP growth to reach 7.3 percent (2.2 percent quarter-on-quarter) and 7.6 percent (2 percent quarter-on-quarter) in the third and fourth quarters respectively. ----- JULIA WANG Greater China economist of HSBC Holdings Plc However, upward leeway for exports is limited. We expect Chinese exports to normalize in the second half - high-single-digit growth at most. The property market slowdown is still the biggest concern for China. Though related industries such as cement and household appliances are fine so far, the impact will show up in the second half or next year if investment keeps shrinking. Therefore, the 7.5 percent target will not be hard to achieve, as long as the government offsets the impact of the real estate sector, which could slide further. ----- SHEN MINGGAO head of China research at Citigroup Inc

This will be reflected in improved manufacturing, private sector investment and infrastructure investment, which will be boosted by the government's approval fast track. We expect no major loosening in the money supply. ----- GAO YUWEI researcher with the Institute of International Finance, Bank of China Ltd

We expect the government to continue to raise infrastructure and public service investment, accelerate reforms to facilitate investment as well as household consumption, maintain a relatively accommodative monetary and credit policy stance, and keep the yuan from further appreciation against the dollar. ----- WANG TAO chief China economist with UBS AG Nevertheless, it should be noted that the Chinese economy is transitioning away from a "growth-at-all-cost" model, as the new leaders focus their attention on market reforms, restructuring and rebalancing - the "New Normal" for China. This means that an annual growth trend near the current target of 7.5 percent would be appropriate, and the days of high-flying growth are truly behind us. Therefore, it is likely that the central bank will continue to pursue neutral monetary policy with a targeted easing approach instead of a broad-based change in interest rates. ----- SUAN TECK KIN senior economist, UOB Economic-Treasury Research

So we think the government will likely continue its mini-stimulus in the face of a higher base effect and some strong headwinds in the second half of the year. ----- TING LU China economist, Merrill Lynch (Hong Kong) We expect the government to continue to accelerate fiscal spending and open up more infrastructure sectors to private sector participation. Tax cuts and measures to support consumption and exports will be maintained. We expect the central bank to keep interbank interest rates relatively low. ----- JIAN CHANG China economist of Barclays

Editor's Note: On Wednesday, the National Bureau of Statistics issued key economic data for the first half of this year. We share comments from leading economists.

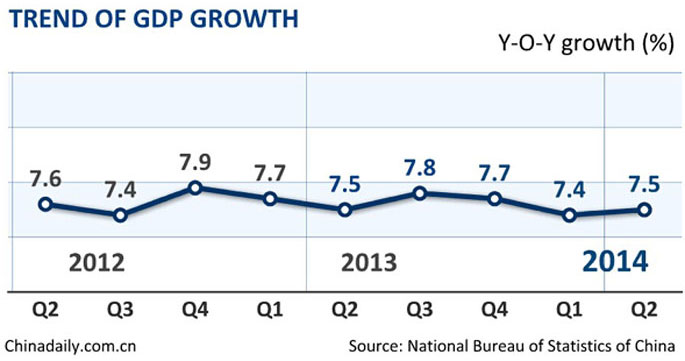

Missing its whole-year growth target, the Chinese economy still proved resilient after it expanded by 7.4 percent year-on-year in the first half of this year.

The stronger-than-estimated half-year data are fueled by easing measures. M2 growth rose very fast to 14.7 percent in June, far beyond the target of 13 percent. It also benefited from improving exports in the second quarter, which we expect to continue based on the US recovery and mild appreciation outlook for the yuan.

We expect GDP growth in the third quarter to reach 7.6 percent as stimulus measures taken in past months kick in and show their effects.

We are upgrading our forecast for China's GDP growth for 2014 to 7.6 percent from our previous forecast of 7.3 percent. For 2015, we are also ratcheting up our projection for China to 7.5 percent from 7.3 percent.

The major economic driver is Beijing's stimulus measures focusing on increased spending on railways and social housing. The negative impact of the stimulus on the financial system is thus relatively small, in our view. We believe Beijing is serious about its 7.5 percent growth target as it needs a stable economic and financial backdrop as it steps up its anti-corruption campaign.

GDP growth and June data provided modest upside surprises. We continue to look for declines in housing prices in the third quarter and expect a further improvement in home sales. To achieve a 7.5 percent growth target, quarterly GDP growth needs to be at least 8 percent-8.5 percent year-on-year in the second half.