Services get a lift from construction

By CHEN JIA (China Daily) Updated: 2014-12-04 07:48

|

|

Workers load a cargo plane in Nantong, Jiangsu province. Growing e-commerce shipments have boosted activity in the logistics sector, adding further momentum to the services PMI last month. XU CONGJUN/CHINA DAILY |

Sector adds staff, firms' confidence increases in Nov as restructuring picks up speed

A rebound in construction gave a boost to the service sector last month, the National Bureau of Statistics and the China Federation of Logistics and Purchasing said on Wednesday.

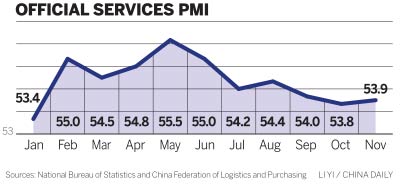

The official services Purchasing Managers Index, a composite indicator covering operations in the service sector and the construction industry, climbed to 53.9 in November from a nine-month low of 53.8 in October, the bureau said. The index stood at 54 in September.

A PMI figure above 50 means expansion, while one below 50 signals contraction.

CFLP Vice-Chairman Cai Jin said a rebound in the housing market has stimulated new orders.

Also, the annual Nov 11 Singles' Day e-commerce event boosted activity in the logistics sector, specifically for express delivery and warehousing companies.

"The service industry is playing a more important role in stabilizing overall economic growth," said Cai.

Nonetheless, he said, global commodity prices remain under pressure, and that might worsen imported deflation in the near term. "More measures should be taken to support growth," he added.

A separate report by HSBC Holdings Plc showed China's services PMI improved slightly to 53.0 in November from 52.9 in October, driven by increased new business.

New orders for service providers increased at the fastest rate since May 2012.

While job losses worsened in the manufacturing sector, staffing increased at service providers, and companies in the sector expressed greater optimism on the business outlook, the bank said.

Qu Hongbin, chief economist in China at HSBC, said: "We expect the central bank's recent rate cuts will help stabilize demand in the near term. However, downside pressures on the economy persist and warrant further monetary and fiscal easing measures in the coming months."

The NBS released the November manufacturing PMI on Monday. That indicator eased further to 50.3 from 50.8 in October, suggesting that GDP growth may moderate in the fourth quarter.

The weak external and domestic demand is likely to show up in other major economic indicators, including consumer inflation, industrial output and fixed-asset investment.

Those statistics are scheduled for release next week when the annual Central Economic Work Conference is likely to be held. At that meeting, senior leaders will discuss macroeconomic policies and targets for the coming year, as well as key reforms in 2015.

Wang Tao, chief economist in China at UBS AG, said: "We expect the government to set a 7 percent GDP growth target for 2015 and an accordingly lower broad money supply growth target".

- China Mobile wages war for new-age telecommunications

- US extends anti-dumping duties on PET film from China, UAE

- US official hails results of trade talks with China

- Light festival kicked off in Shenzhen

- China's high-speed rail traffic to grow within 20 years

- Nation gets WTO ruling on US duties

- Shandong moves to curb LGFV debt

- Moscow's woes spark closer links