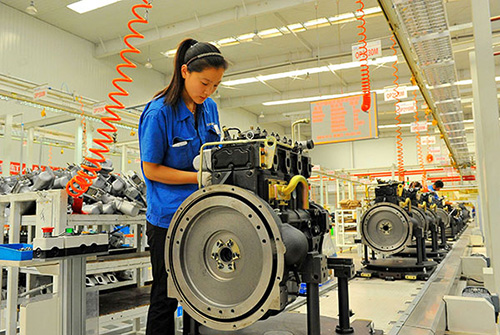

China's producer prices improve in May

(Xinhua) Updated: 2016-06-09 13:52BEIJING - China's producer prices continued to fall in May, but the contraction narrowed from April in a sign of improved aggregate demand in the industrial sector, official data showed on Thursday.

The producer price index (PPI), a measure of costs for goods at the factory gate, dropped 2.8 percent year on year in May, narrowing from a 3.4-percent drop in April and a 4.3-percent decline in March, according to the National Bureau of Statistics (NBS).

The reading marked the 51st straight month of decline as China's economic slowdown and industrial overcapacity weighed on prices.

Output price drops in oil, natural gas and coal, oil refining, ferrous metal smelting, chemical raw materials and chemical products contributed around 60 percent of the total producer price decline, said NBS statistician Yu Qiumei.

HSBC attributed the easing PPI contraction to extended gains for bulk commodity prices and increasing infrastructure and property investments during the period.

On a month-on-month basis, May's PPI inflation edged up 0.5 percent.

Output prices of production materials went up 0.7 percent from the previous month, contributing 0.5 percentage points to the PPI gain during the month.

The data came along with the release of the consumer price inflation index (CPI), which rose 2 percent year on year in May, narrowing from the 2.3-percent growth in April.

- Nubia launches new phablet, eyes niche market in China

- China opens Horgos railway port in Xinjiang

- Swire Group bets on China growth

- Brand logo for China-Europe container trains put into use

- China establishes fund to invest in advanced manufacturing

- High-end lifestyle goes mobile

- Myanmar's economic zone near China border to be completed in 2017-18

- Central bank drains 40b yuan from market