Car imports go into reverse

First six-month fall since 2006; dealers grapple with inventories

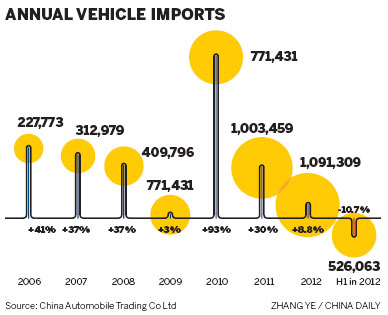

Vehicle imports slumped 10.7 percent in the first half, to 526,000 units, as the domestic demand slowdown of the past two years drove up inventories of foreign cars.

Customs figures also show that the decline was the first half-year contraction since 2006, when China implemented its World Trade Organization commitment to lower the import tariff for vehicles to 25 percent.

The figures "indicate that dealers are making efforts to ease their high inventory pressure, as imported vehicle sales in China are still increasing this year, though growth slowed from years before sharply", said Wang Cun, a senior manager of China Automobile Trading Co Ltd, the country's largest vehicle importer.

According to the company, in the first five months, sales of imported vehicles increased 8 percent from a year earlier to 447,000 units, compared with growth of 76.1 percent in 2010, 29 percent in 2011 and 18.7 percent in 2012.

"The high market demand and growing speed made the dealers raise their expectations and order more vehicles from outside China.

"However, the sudden slowdown in the domestic market led to an oversupply, and dealers suffered from increasing inventories from the fourth quarter," said Wang.

"To ease the inventory pressure amid a continued market slowdown, they need to reduce imports," he added.

Statistics from the company show that in May, dealers' average inventories of imported vehicles stood at 2.7 times monthly sales.

"That means the dealers will continue their market promotions, including price cuts and other offers, to cope with the high inventory," said Wang.

According to the company's second-half forecast, the growth rate for imported vehicle sales in the world's largest automobile market will continue to slow to a range of 8 to 10 percent.

By segment, sport utility vehicles continued to dominate the imported sector, with 61 percent of overall sales.

In the first five months, China imported 271,000 SUVs, the only segment that was still increasing, for a gain of 17.3 percent.

In comparison, sedan imports fell 3.5 percent to 159,000 units and imports of multi-purpose vehicles stood at 16,000 units, down 5.2 percent.

The share of vehicles imported from Germany (Mercedes-Benz, Audi and BMW) dipped 3.2 percentage points to 66.5 percent.

Demand for vehicles from the United States surged, lifting their market share by 4.2 percentage points to 12.3 percent in the imported segment.

Wang said that in the second half, there is "potential" in European branded vehicle imports, excluding those from Germany, while the US share will continue to rise.

China's first-half vehicle exports saw a slowdown. Half-year growth ground to a near-halt, slowing from 29.7 percent in 2012 to just 2.29 percent this year.

China's top vehicle exporter, Chery Automobile Co, saw exports fall 49.6 percent in June and 24.82 percent for the first half.

The latest figures from the China Association of Automobile Manufacturers show that in the first half, China's domestic vehicle production and sales both surpassed 10 million units, with year-on-year growth of more than 12 percent.

The association said that the double-digit growth can be attributed to surging demand for passenger vehicles, led by sedans and SUVs.

In the period, 8.66 million passenger vehicles were delivered to Chinese consumers, up 13.8 percent from a year earlier. SUV deliveries surged by more than 40 percent.