Sales surge in June, but downdraft looms

|

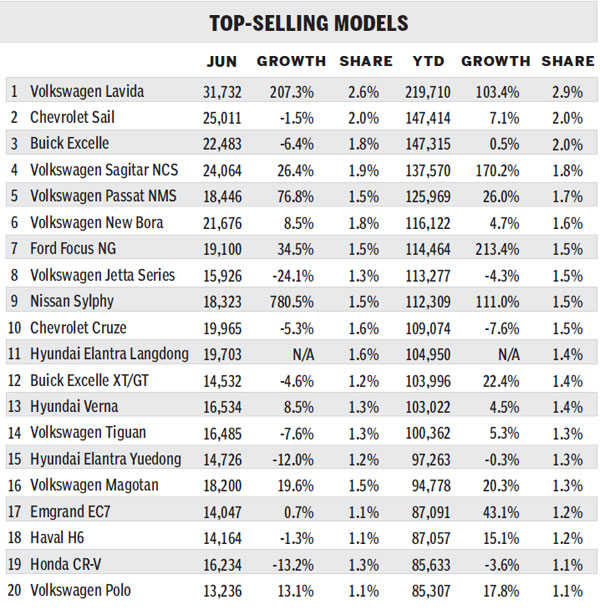

Shanghai Volkswagen sold 31,732 of its Lavida model in July to retain the sales champion title. Huang Jiexian / for China Daily |

Slowing economy and sales restrictions in some cities

As we expected, sales of light vehicles - including passenger and light commercial vehicles - in June continued May's trends, rising 8.5 percent year-on-year to 1.72 million units.

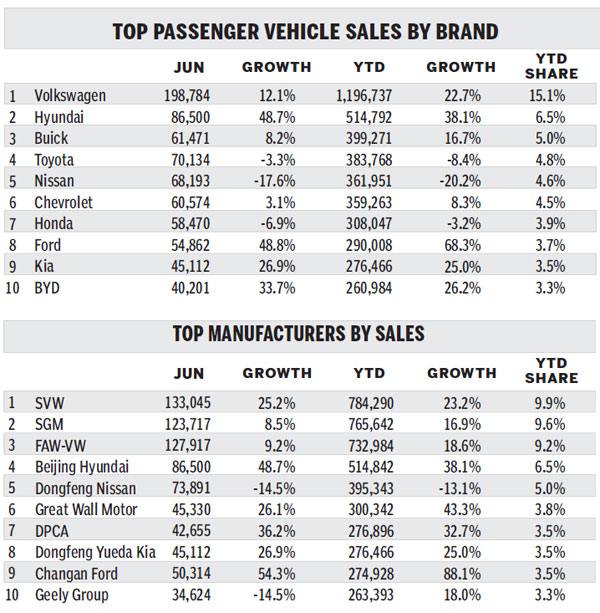

Passenger vehicle sales reached 1.32 million units, slightly higher than May.

Light commercial vehicle sales increased by 4.2 percent year on year to 400,000 units.

Based on first-half figures, full-year sales of light vehicles are projected to hit 21.05 million units, up 12 percent year on year.

Estimates for passenger vehicles remains high at 16 million units sold in 2013, up 14.9 percent, while the total for light commercial vehicles is projected to reached 5.1 million, up 4 percent.

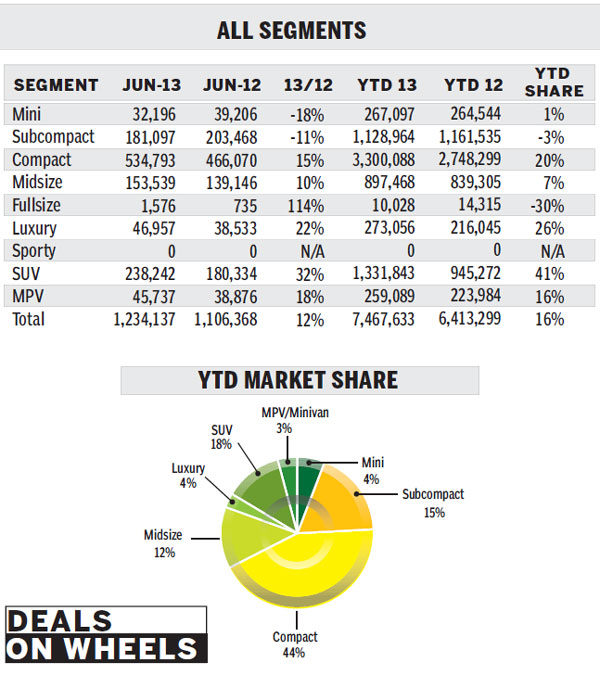

The SUV segment remained the main contributor to sales growth in June, when 286,000 units were sold, up 23 percent year on year.

Strong SUV sales mainly came from newly launched models such as the Ford Kuga, Hyundai Santa Fe, Ford Ecosport and Peugeot 3008.

The entry-level minicar and subcompact segments continued to perform sluggishly in the face of fierce competition from the compact cars and SUVs.

The compact car segment performed much better, thanks to the strong demand for the Volkswagen Sagitar and Bora, and some other newly launched models. More than 3.3 million compacts were sold in the first half of the year, up 20 percent from 2012.

Japanese brand vehicles continued to lose ground in China, selling only 1.38 million units in the first half, down 11 percent year on year.

In contrast, most non-Japanese carmakers increased sales, especially Korean carmakers, whose combined numbers in the first half surged 29 percent.

As the economy slowed, we found that the strong 19 percent growth in vehicle sales in the first quarter "normalized" in the second quarter by rising 12 percent.

As we mentioned in the previous executive summary, the risks of slowing sales growth continue to accumulate. We forecast growth in the second half will decline to 10.2 percent.

As well, more regulations to limit new car purchases will probably be implemented in several second-tier cities in order to reduce air pollution.

According to China Association of Automobile Manufacturers, 400,000 potential new vehicle sales could be eliminated, more than 2.5 percent of the total passenger vehicle market.

To summarize, we retained our passenger vehicle forecast for 2013 at 16.07 million units, up 12.8 percent. We also retained light commercial vehicle forecast at 5.3 million units, up 6.2 percent.

However, since no subsidy policies are expected in the second half and growth in fixed-asset investment was weaker than expected, we will decrease the light commercial vehicle forecast in the next few months.

The writer is a market analyst at LMC Automotive, who can be contacted at XCui@lmc-auto.com