No reining in Chinese vehicle firms

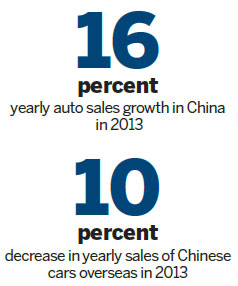

By Andrew Thomson (China Daily) Updated: 2014-03-04 07:59Exports remain one of the few areas of weakness, with sales of Chinese cars overseas dropping nearly 10 percent in 2013 due to softening demand in emerging country markets in South America and the Middle East. With the yuan likely to continue its appreciation against the dollar and other currencies this year, combined with the continued buoyancy of the domestic China market, a further drop in exports looks likely for this year.

Further out, though, matters should improve. Shenzhen-based BYD has announced plans to start selling four models in the US in 2015, which would make it the first Chinese car maker to sell into what is still the world's richest auto market, while Qoros, the Sino-Israeli joint venture between Chery Auto and Israel Corp, has started test marketing cars in Slovakia as a first step towards selling into Europe.

Consolidation of China's fragmented auto industry still looks a long way off. Despite being home to more than 170 different vehicle makers, and reducing that number being an official goal for the last seven years, the combination of local government support for firms in their own backyards, plus the need for any merger or acquisition to be signed off by a host of central government bodies, has resulted in almost no progress.

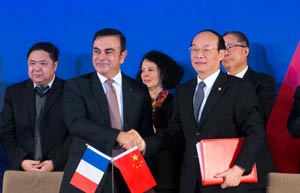

Chinese car makers are likely to continue their search for overseas acquisitions that can boost their scale and especially their access to technology. The recent announcement that Wuhan-based Dongfeng Motor's would be buying 14 percent of PSA Peugeot Citroen for 800 million euros should smooth the way for transfers of both R&D and supply chain knowledge – vital if the two companies' China-based joint ventures are to meet their goal of doubling annual sales to more than a million cars annually.

This year is also unlikely to see any significant lifting of the rules restricting foreign ownership of car makers in China to a maximum of 50 percent. Although officials have spoken out about relaxing these conditions, with foreign brands dominating the Chinese market – indeed, slightly increasing their share – it is hard to see any change taking place before at least one domestic car maker has established itself as a force in the market.

When that might happen is anyone's guess. For certain it won't be in the Year of the Horse, while the race track will remain the preserve of the heavyweight Sino-foreign joint ventures. But as Ford's rapid rise last year demonstrated, who will be the eventual winners in the China car market remains an open question – and one unlikely to be decided before the end of this decade. Which horse to back is the main issue for discussion.

The author isAsia Pacificand China head of automotive and a partner at KPMG China. The views do not necessarily reflect those of China Daily.

|

|

| Top 10 most valuable auto brands | Top 10 moves by carmakers in China |

- Premier Li meets with Timor Leste's Prime Minister

- China encourages development of private healthcare

- Lufthansa Cargo strengthens its presence in China

- China battles for rags-to-riches stories

- Cars, models at 10th Manila Intl Auto Show

- Jack Ma to acquire 20% of Wasu Media

- XP's demise helps Chinese IT developers

- GM planning lower-priced version of 2016 Chevy Volt