Vehicle sales slow in Nov amid economic concerns

By Li Fangfang (China Daily) Updated: 2014-12-06 08:08

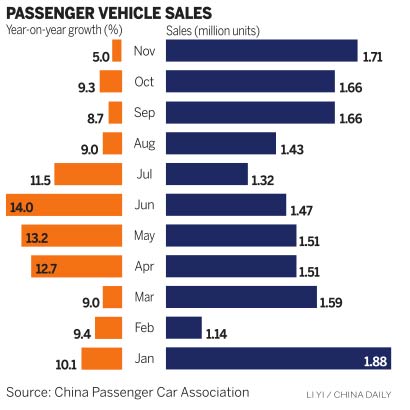

Vehicle sales slowed drastically in China in November, as concerns over the cooling economy and purchase limitations in cities weighed heavily on buyers, industry sources said on Friday.

The total sales of cars, sport utility vehicles, multipurpose vehicles and minivans increased by only 5 percent on an annual basis to 1,710,113 units last month. Vehicle sales during the first 11 months posted a 10.3 percent year-on-year growth, the China Passenger Car Association said.

Rao Da, secretary-general of the association, said: "The weak market response is a bit lower than expected for the off season. The added pressure on dealer inventories will prompt companies to launch more sales promotion campaigns."

According to Rao, the situation is not expected to see much improvement in December, unlike in 2013 when the last month of the year saw robust sales ahead of purchase restrictions in cities like Tianjin.

Although China's GDP is expected to maintain a stable growth of about 7.3 percent in 2015, Rao believes that investment, consumption and industry will still face challenges.

"From an economic perspective, vehicle consumption potential will decline in 2015. However, we still forecast a 10 percent growth for the whole of 2015, thanks to rising income, low fuel prices and growing trade-in plans," said Rao.

He said that the expected blackout of the subsidy plan for energy-saving vehicles by the end of 2015 will stimulate vehicle purchases in the second half of 2015.

According to data provided by research firm IHS Automotive, vehicle sales will see more moderate growth in China next year, with passenger vehicles being the mainstay.

IHS Automotive said: "The Chinese market is witnessing slower overall growth rates than seen in previous years, but we forecast passenger vehicle sales (sedans, SUVs and MPVs) for this year to grow by 10.88 percent over last year to 17.9 million units."

For 2015, the firm expects a growth of 7.89 percent in passenger vehicle sector and sales of about 19.36 million units.

"This is based on projections for GDP growth of 7.1 percent in 2015, compared with 7.3 percent GDP growth for 2014. Overall the rates of growth within the segment are slowing, as is the entire market," said IHS Automotive.

In 2010, passenger vehicle sales stood at 11.6 million units, rising to 12.64 million in 2011, with year-on-year growth of 8.7 percent. The sales in 2012 rose a further 7.88 percent to 13.64 million, and in 2013 increased 18.64 percent from a year earlier to 16.18 million.

"The premium car segment, which includes the key players such as Audi, Mercedes and BMW, is expected to see double-digit growth rates in 2015, but the growth rates will still decline from previous years," IHS Automotive said.

The company expects the premium segment to achieve combined sales of 1.8 million units this year, a 21 percent year-on-year growth, while in 2015 the segment is expected to reach 2.07 million units, a 14.61 percent growth.

- China stock index futures close lower on Dec 22

- Shanghai Index close to five-year high

- Chinese shares close mixed on Dec 22

- Chinese lawmakers hear report on enforcement of tourism law

- China opens rural work conference to plan for 2015

- Retailers lure Christmas shoppers with goodies

- Stock market to see slow growth, but bright outlook

- Hearing the call of opportunity