Slowing growth for auto imports

By LI FUSHENG (China Daily) Updated: 2014-12-29 10:14But dwindling profit margins are straining relations between some international automakers and their dealers, Ding said when he addressed the forum.

He said automakers should change their rapid growth-oriented strategy and seek a sustainable road of development for their own operations and their authorized dealers.

Many insiders agree that automakers should speed up their pace of change as fundamentals in the industry are likely to shift in 2015 after changing policies on imports by non-authorized dealers and new-energy vehicles.

Ding estimated that growth in the auto market as a whole will slow to around 7 to 8 percent in 2015. The auto industry had an average compound growth rate of 25 percent from 2000 to 2010.

Market in 2014

The market for imports vehicles has changed in many ways this year, according to the report.

European brands still have the lion's share but it has fallen from 64 percent last year to 58 percent in September.

The share for US brands has grown from 12.6 percent to 16.7 percent in the same period. Imports of Cadillac cars have more than doubled and Ford has had a 70 percent surge.

But SUVs remain the most popular imported vehicles. Statistics show that a total of 655,000 SUVs were imported in the first three quarters of the year, 62.8 percent of the total.

In the first three quarters, nine out of 10 best-selling imported models at dealers were SUVs, with Toyota's Prado ranking first with sales of 34,700 units.

Imported sedan sales rose 23 percent rise while MPVs registered 17 percent growth.

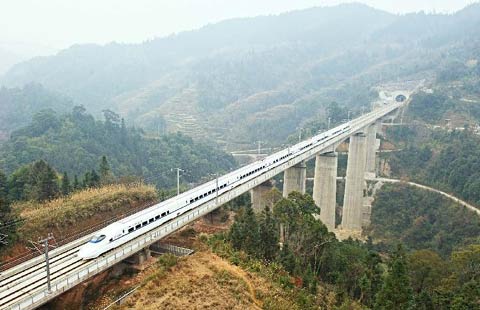

By region, sales of imported vehicles are growing faster in central and western China.

Statistics show that nearly 45 percent of all imports sold in the country in the first nine months were sold in those regions, while the share in eastern and northern markets has gradual shrunk.

- Michelin's 'Green Paper' from Chengdu on challenges ahead

- Conference will imagine future of the car industry

- Slowing growth for auto imports

- Volkswagen, Chrysler, GM recall defective vehicles in China

- GAC plans expansion in overseas markets

- Challenge to monopolies in banking

- Staying the course on structural reforms

- China's 2014 transport infrastructure investment to hit 2.5t yuan