China's auto market feels global chill

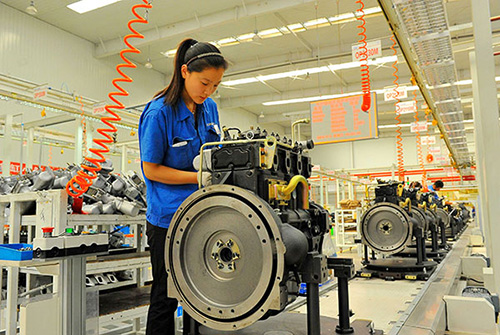

By Li Fusheng and Gong Zhengzheng (China Daily) Updated: 2015-11-20 09:53Miao Wei, minister of industry and information technology, indicated that Chinese carmakers are far from competitive. "There are 184 local players, so we will continue our pace to reshuffle the market and eliminate those unqualified players," he said.

He also urged Chinese carmakers to upgrade their technology and launch industrial restructuring soon.

"If they can't catch up to speed, a new industrial shakeup is ready," he said.

NEV boom

New-energy vehicles, however, offer a different and reassuring story despite the overall slowdown of China's auto market.

Through the first 10 months, China sold 171,145 new-energy vehicles, a 290-percent rise from the same period last year, with pure electric models taking up a majority of that figure.

More evidence for new-energy vehicles' popularity in China is that five out of 10 best-selling models worldwide in September were from Chinese carmakers-Geely's electric Panda, BYD's Tang and Qin, BAIC's E series and SAIC's Roewe 550-according to a report by news portal OFweek.

BYD's Qin ranked fourth and BAIC's E series ninth among the top 10 global bestsellers in the first three quarters of the year, the report said.

International automakers are also stepping up their efforts in the new-energy vehicle segment.

Volkswagen said it would locally produce more than 15 different models of plug-in hybrids or fully battery-powered cars within four years, with production expected to start in 2016.

Ford will introduce two new-energy vehicles-the C-Max Energi and the Mondeo hybrid-to the Chinese market from 2016, the US automaker's CEO Mark Fields said last month in Shanghai.

Mercedes-Benz's parent company Daimler rolled out an electric model called Denza with its Chinese partner BYD late last year.

BMW is selling i3 and i8 new-energy vehicles, as well as the Zinoro from its joint venture BMW Brilliance in the Chinese market.

Auto shows are dedicating separate halls to new-energy cars. Organizers of the Guangzhou auto show have doubled the floor space to 20,000 square meters for such cars and visitors to those halls are exempt from ticket charges.

"The Chinese market has seen rapid growth since 2014. We predict that the next five to 10 years will be an important phase for the industry," said Jin Jun, a PwC China advisory partner.

- LeTV sponsors think tank championing 'sharing finance'

- First domestic regional jet delivered

- Lock-up shares worth 46.8b yuan to become tradable

- Volatile markets take toll on fund managers

- 500 firms ready for leap to GEM listings

- Farmer's daughter makes massive strides in service

- Learning process can help hone skills

- Border trade with Vietnam flourishes in Dongxing