Meteoric rise in SUV sales but risky to rely primarily on sector

By John Zeng (China Daily) Updated: 2016-04-25 10:11

|

|

The Trumpchi GS4, among the most popular SUV models in China, is on display at the 2015 Detroit auto show. Provided To China Daily |

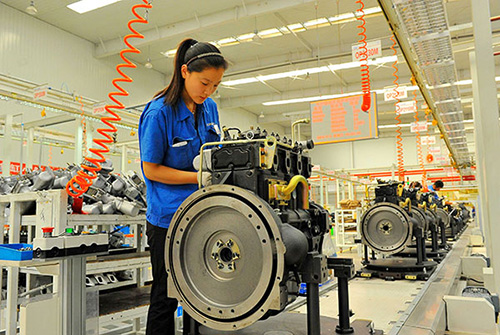

As sales of SUVs continue to boom, Chinese automakers have seen a meteoric rise in their share of this market segment.

According to the latest data released by the China Association of Automobile Manufacturers, sales of Chinese-branded passenger vehicles rose by over 17 percent in the first quarter of 2016, compared to the same period in 2015, outpacing the rate of growth in the overall passenger car market, which grew by an average of 8.9 percent in the first quarter.

Local brands saw their market share soar to 42.5 percent, in contrast to growth of just 3.5 percent year-on-year for foreign-branded models.

A closer look at the data reveals that Chinese automakers sold more than 1.14 million SUVs in Q1, a phenomenal rise of 58 percent on 2015, with SUV sales accounting for nearly 50 percent of the total volume generated by local original equipment manufacturers.

In fact, 58 percent of the SUV segment in China is now dominated by local brands. Among the top 10 bestselling SUV models, seven belong to Chinese OEMs, namely the Havel H6, Baojun 560, Trumpchi GS4, Changan CS75 and CS35, Refine S3 and Brilliance V3. The VW Tiguan, Buick Enclave and Honda CR-V are the only three foreign models that succeeded in making it into the top 10.

The strong sales momentum of Chinese brands in the SUV segment shows every sign of continuing as 2016 unfolds, even as underlying concerns for the automotive market as a whole are beginning to emerge.

Against the background of thriving SUV volumes, sales of Chinese-branded cars tumbled by more than 22 percent to just 541,000 units in Q1 2016. This disproportionate growth begs the following question: To what extent will this heavy reliance on the SUV market affect local brands moving forward?

In our view, this disproportionately high performance in the SUV segment is likely to limit growth to the short term for Chinese OEMs, leaving them exposed to a high level of risk in the longer term.

The risks are twofold. The first comes in the form of China's stricter emissions standards, with the government striving to improve the country's air quality.

As part of these efforts, Phase IV of the Passenger Car Fuel Standard was implemented on Jan 1, with the aim of reducing average fuel consumption to 5.0 liters per 100 kilometers by 2020.

More specifically, automakers are required to reduce fuel consumption by 4 percent, 6 percent, 8 percent, 10 percent and 10 percent each year from 2016 to 2020.

This will present a tough challenge for the majority of Chinese OEMs given that, in 2014, more than 37 of them failed to comply with the third phase of the fuel consumption requirements.

With an increasing number of SUVs appearing in every automaker's product portfolio, meeting the new fuel efficiency standards will become ever more taxing, especially since the average weight of a car on China's roads has risen by over 13 kilograms in the last few years, which will only serve to bring down the average fuel efficiency level.

With nearly 50 percent of overall sales in the market being generated by SUV models, Chinese automakers will be seriously challenged when the fourth phase of the fuel consumption standard is enforced in 2020, and any potential penalty taxes could wipe out the price advantage they currently enjoy.

The comparatively lower cost of Chinese-branded SUVs presents the second risk.

Most locally-branded SUVs compete in the low/economy price segment, with sticker prices ranging from around 50,000($7,700) to 100,000.

While this strategy provides value for money for consumers, it has essentially wiped out a substantial proportion of sales in the car segment, since SUVs are priced competitively with car models.

It should come as no surprise therefore, that Great Wall abandoned its car program two years ago to focus exclusively on the development of SUV models.

Other leading Chinese automakers like JAC, Changan and GAC have also relied more heavily on their SUV products as their market share of the car segment has been progressively eroded.

Compared to local car manufacturers, foreign OEMs have succeeded in better balancing their product portfolios, producing fuller ranges, including cars, MPVs and SUVs.

However, if they were to decide to tap into the low-cost/economy SUV segments, they would run the risk of negatively impacting sales of the car and MPV models they launch in the market, particularly since car sales accounted for 72 percent of their overall outturn during the first quarter of 2016.

That being said, this does not mean that non-domestic automakers will shy away from the low-cost/economy segment forever.

Indeed, the independent joint-venture brands operating the market are likely to attack the lower-end SUV segments in the near future, thus potentially threatening the low-price strategy adopted by local brands.

In short, while the booming SUV segment has provided a major growth opportunity for Chinese vehicle manufacturers, there can be little doubt that it is a double-edged sword in that China's new fuel efficiency regulations and the potential competition from joint-venture brands are likely to constrain further growth in the SUV segment for China's automakers.

The author is managing director of LMC Automotive.

- China to revitalize northeast rustbelt

- China's newly installed wind power capacity grows 13% in Q1

- China's Q1 outbound M&A deal value exceeds all annual figures

- China SOEs profits fell 13.8% in Q1

- PE market's deal value jumps to $69b in 2015, says Bain & Co

- China raises retail fuel prices

- Insurers report 42.18% surge in Q1 premium revenues

- Alibaba financial affiliate raises record $4.5b