Sinograin looks at overseas deals to feed demand

Updated: 2012-12-12 10:17

Firm says step will strengthen control over supply of palm oil, soybeans

Sinograin Oils Corp, the oil-making arm of the State-owned conglomerate China Grain Reserves Corp, is targeting overseas investments in South America and Southeast Asia to strengthen its control over the supply of foodstuffs such as soybeans and palm oil.

Sinograin Oils Corp, the oil-making arm of the State-owned conglomerate China Grain Reserves Corp, is targeting overseas investments in South America and Southeast Asia to strengthen its control over the supply of foodstuffs such as soybeans and palm oil.

Wang Qingrong, the company's vice-president, said eyeing overseas investments remains its "medium-term strategy and we are unlikely to take action within two years".

At the start of this year, Sinograin announced it planned to expand its commercial soy-crushing operation to profit from the country's rising demand for cooking oils and animal protein.

The expansion was seen as a move to help it compete for market share with Singapore-based Wilmar International, which now has the biggest crunching capacity and market share for consumer pack edible oils in the country through its China operation, Yihai Kerry.

Sinograin began to sell its own brand consumer pack soyoil to supermarkets late last year and aims to have sold 200,000 tons by the end of its financial year in February, said Wang.

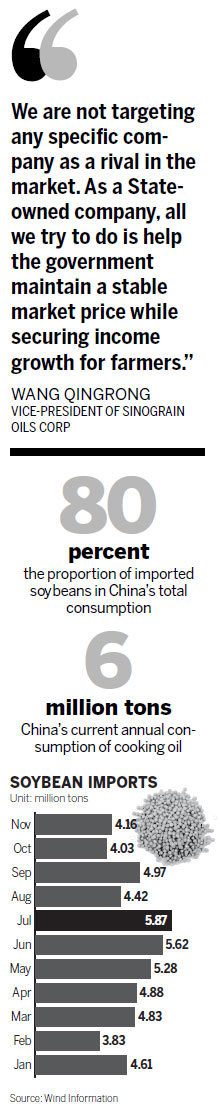

He added that the company is targeting a 10 percent to 15 percent share of China's cooking oil market - which has a current annual consumption of 6 million tons - over the next five years.

"We are not targeting any specific company as a rival in the market," Wang said.

"As a State-owned company, all we try to do is help the government maintain a stable market price while securing income growth for farmers."

However, industry analysts said they believe the planned move to make overseas investments will make the company stronger as it works to narrow the gap with Wilmar and other foreign edible-oil suppliers in the domestic market.

China is currently the world's largest soybean importer. Imported beans account for more than 80 percent of its total consumption.

But last year, the country experienced significant food price hikes as inflation rose.

The current dominance by foreign companies has driven many State-owned companies, such as Sinograin, China National Cereals, Oils and Foodstuff Corp, and China Oil and Food Corp to expand their oil-crunching production to increase the competition in the market.

"Foreign companies such as Yihai Kerry, given their grain trading abilities, are inherently more competitive in various areas of the business, not simply processing," said Ma Wenfeng, a senior analyst at Beijing Orient Agribusiness Consultant Ltd, one of the industry's largest specialist consultancies.

To compete with their foreign rivals, "big Chinese companies should try to move up the value chain to control supply, whether through investments or cooperation", Ma added.

Sinograin Oils, set up in 2008, has already said it plans to expand its market share for its own brand of cooking oil by boosting its production capacity and building its business networks across the country.

Over the past five years, it has spent 1.8 billion yuan ($279 million) at its Zhenjiang production base, for instance, equipping it with 920,000 metric tons of storage capacity, one million tons of annual soybean crunching capacity, and 500,000 tons of annual refining capacity.

zhousiyu@chinadaily.com.cn

- BYD exports three electric cars to Thailand

- Grid gets first jolt of residential solar power

- US now largest buyer of China's exports

- China's outbound M&As on the rise

- Tobacco control may entail price, tax rises

- Quanzhou becomes pilot financial reform zone

- New automobiles shine at Geneva Motor Show

- World's longest high-speed rail 'on track'

- Jiugui Liquor involved in plasticizer scandal again

- Accident reignites school bus safety concerns

- China to revise labor law

- Trademark registration under scrutiny

- Dinner ban takes toll on liquor firms

- CIC tables bid for London's Chiswick Park

- Property buyers eye overseas market

- Call for law to protect personal information

- China to cut train ticket prices

- Christmas business

- Solar industry to get jolt from new policies

- KFC chicken under spotlight