Internet giants busy in M&A market

By Cai Xiao (China Daily) Updated: 2014-07-24 07:17

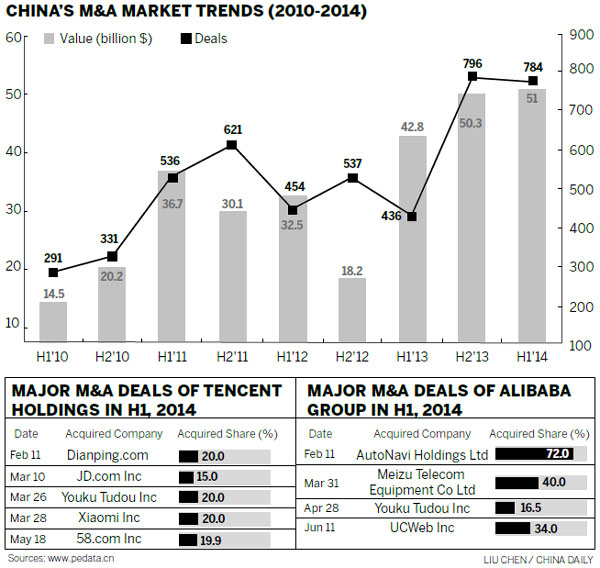

The Chinese merger and acquisition market continued to be active in the first half of 2014, with listed Internet giants all striving to acquire good assets.

Completed M&A deals in China totaled 784, a 79.8 percent year-on-year increase and the 717 disclosed deals totaled $51 billion, a 19 percent increase year-on-year, according to a report by Zero2IPO Group.

In addition, 829 deals were announced during this period, of which the 650 disclosed deals amounted to $108.7 billion.

The sectors proving most popular for mergers and acquisitions included the Internet, real estate, electronics, healthcare and mining.

|

|

|

Chinese e-commerce firm Alibaba Group Holding Ltd, which has submitted an updated initial public offering prospectus to the US Securities and Exchange Commission, spent about 30 billion yuan ($4.8 billion) to invest in more than 12 companies in the first six months, according to Zero2IPO.

Alibaba announced this month that it had completed the acquisition of AutoNavi Holdings Ltd after a proposal in February to take full control of the US-listed digital mapping company.

In May last year, Alibaba acquired 28 percent of AutoNavi's shares for $294 million. Its all-cash offer in February proposed to acquire the remaining 72 percent at $21 per American depositary share, which values AutoNavi at approximately $1.58 billion.

Alibaba also purchased stakes in companies including mobile browser firm UCWeb, online video firm Youku Tudou Inc, smartphone company Meizu, TV-and-film production firm ChinaVision Media Group Ltd and media operator Guangdong Twenty-first Century Media Co Ltd.

Zero2IPO also said that US-listed Tencent Holdings Ltd, China's largest Internet company by revenue, acquired more than 11 companies in the first half this year and the value will be at least 20 billion yuan.

Tencent paid $736 million in June for a 19.9 percent stake in online classified ads provider 58.com Inc, and it also invested in Chinese smartphone manufacturer Xiaomi Inc, Chinese e-commerce company JD.com Inc, online video firm Youku Tudou Inc and restaurant-rating and group-buying service provider Dianping.

- Craw-ling with potential

- China textile, apparel trade show draws crowds in New York

- Top 10 profitable companies in China 2014

- 2M alliance charts ships' new course

- Officials urged to cut company ties

- Microsoft to stem Nokia losses 'in 2 years'

- External debt level under control, SAFE says

- Meat supplier in China scandal has global reach