Apple tops smartphone vendor in China in Q1

By Liu Zheng (chinadaily.com.cn) Updated: 2015-05-11 15:49

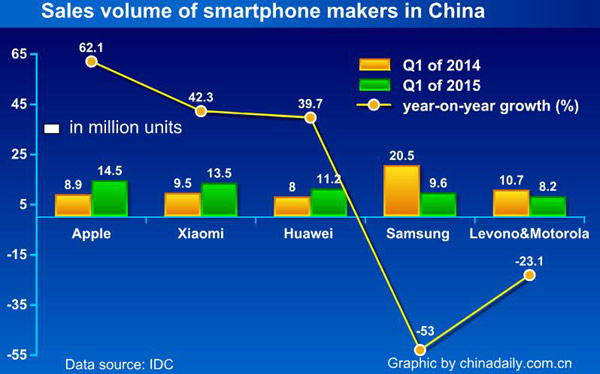

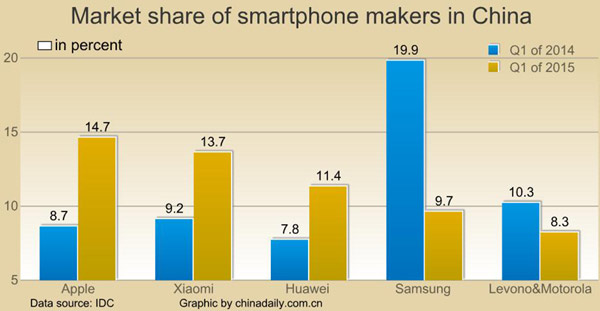

With 14.5 million units' sales volume, Apple became the top smartphone vendor in China in the first quarter of this year, said a report released by market intelligence firm International Data Corporation (IDC) on Monday.

According to the report, the latest iPhone 6 and iPhone 6 Plus have boosted the demand of Phablet in Chinese market.

Statistics from IDC showed that domestic smartphone market saw intense competition in the past five quarters, as the top position witnessed frequent changes with Samsung, Lenovo, Xiaomi, Apple all occupying the spot alternatively.

"Smartphones are becoming increasingly saturated in China," said Kitty Fok, director of IDC China. "China is oftentimes thought of as an emerging market but the reality is that the vast majority of phones sold in China today are smartphones, similar to other mature markets, such as the US, UK, Australia and Japan. Convincing existing users as well as feature phone users to upgrade to new smartphones will now be the key to further growth in the market."

Smartphone market in China fell for the first time in six years in the first quarter of this year, with the volume reaching 98.8 million units, a drop of 4.3 percent year-on-year, said the report. China's overall mobile phone shipments reached 109.8 million units, a fall of 5.6 percent compared to the previou year.

"Some brands experienced major slump in sales this quarter," said Wang Jiping, chief research officer of IDC China.

"Another reason for the decline in overall sales is that customer loyalty isn't what it used to be, and that is why we are seeing so many brands," Wang added.

According to Wang, to compete with Apple's iPhone 6 and iPhone 6 Plus, domestic makers are keen to improve their innovation abilities to stimulate consumption. In order to reduce the cost of distribution, some of them have developed new selling methods, such as online sales, physical stores, business to business to consumers (B2B2C), and even crowdfunding.

TayXiaohan, Senior Market Analyst with IDC's Asia/Pacific Client Devices Group, told chinadaily.com.cn, that due to the market slowdown in the Chinese mainland, domestic manufactures have accelerated their plans to expand into India and Southeast Asia.

"The golden rule of success is how to depute channels of distribution and build localized marketing strategies," said Tay.

Smartphones that are priced lower than $150 will see more growth, said Tay. The market potential will be realized as more local phone users switch to low-end smartphones.

- Chinese companies in Germany recruit local talents to expand business

- Volvo chooses South Carolina for its first US plant

- China makes fresh efforts to unleash economic vitality

- China's FDI up 11.1% in Jan-April

- Greece avoids default with IMF payment

- China donates agricultural equipment to Georgia

- Startup board boom heralds new economic drivers, risk

- China's stock market volatility normal: US experts