What will die first, cash or password?

|

|

An Apple iphone 6 with Apple Pay is shown in this photo illustration in Encinitas, California, June 3, 2015. [Photo/Agencies] |

The growth in mobile payments will spur the development of China's digital verification industry.

According to the latest report released by domestic consulting company iResearch, the market scale of China's third-party mobile payment more than doubled in 2016 compared with the previous year, reaching $5,500 billion in total.

The number is nearly 50 times larger than the market scale in the US.

Experts attributed the skyrocketing growth of China's mobile payment to late development, saying the lack of credit card culture has accelerated the switch from cash to mobile payment and the emergence of third-party payment enterprises and mobile payment platforms have pushed the growth rate further.

But the fast-paced development has also raised security concerns.

|

|

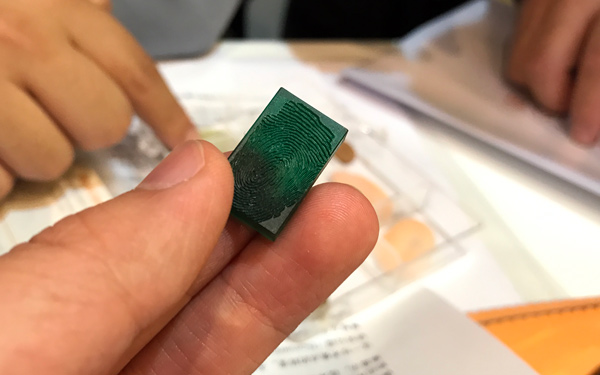

A duplicate fingerprint mold is on display by Precise Biometrics Inc in February, 2017, during the Mobile World Congress held in Barcelona, Spain. [Liu Zheng/chinadaily.com.cn] |

Hakan Persson, CEO of Sweden-based Precise Biometrics Inc, a fingerprint authentication solution provider, said the rise in mobile payments increases security and fraud risks.

"As digital payments and e-commerce keep rising, 60 percent of all transactions will be made through biometric authentication in 2020," added Persson, citing a report by information company Acuity Research.

Therefore it's not surprising that the hardware industry is also growing rapidly.

"The total shipment volume of mobile devices with fingerprint scanner was about 600 million last year, up 100 percent year-on-year, and the number is expected to reach one billion," he added.

And the number is projected to hit 2.5 billion units in 2020.

Persson said that although fraud in mobile payments with fingerprint scanning is low today, but it will increase as the number of users and transactions grow.

He said that fingerprint sensors are vulnerable to spoofing via fake fingerprint molds or even fake fingerprints produced using household materials.

"The more something is easy to use, the less security it has," said Juraj Malcho, the chief technology officer of ESET, a global antivirus software provider who works closely with its Chinese partner Version 2 to deliver IT security solutions to the market.

"All of the 'one-click' or 'no-click' authentication methods can be easily misused," he said.

- Wuxi among China's highest spenders on mobile payment platforms

- Mainland mobile payment services expand rapidly in Taiwan

- Tencent, Starbucks partner to offer quick mobile payment service

- Mobile payment more favored, but security concerns linger: report

- French department store adopts Chinese mobile payment to lure Chinese tourists