JD.com opens first unmanned sorting center

|

|

A delivery worker of JD in Suzhou, Jiangsu province. JI HAIXIN / FOR CHINA DAILY |

JD.com Inc, China's second-biggest e-commerce player, said it has launched the first unmanned sorting center in Kunshan, Jiangsu province, as part of its strategy to build an intelligent and high-efficient logistics system.

The whole process, from parcel sorting to loading onto the trucks, are fully automatic in the Kunshan center, which is also the first of its kind in the world, JD said in a statement.

Compared with traditional automatic sorting centers, JD's is more intelligent and efficient, the company said. The coverage rate of automated equipment has reached 100 percent and about 9,000 parcels can be sorted every hour.

It said the increased parcel handling efficiency meant the new plant could handle four times the packages of the old human-run centers. JD has independently developed an intelligent equipment management and control system, including unmanned automated guided vehicles for loading and unloading goods.

The e-commerce giant said it will continue to increase its investments in technology innovation to provide high-efficient, low-cost and intelligent supply-chain solutions.

Recently the National Development and Reform Commission issued suggestions on "Internet Plus efficient logistics", which proposed building a logistics information sharing system, as well as improving the levels of intelligent warehousing and distribution.

JD is increasingly betting on its intelligent logistics operations to differentiate itself from Alibaba Group Holding Ltd.

Liu Qiangdong, its founder and CEO, said in July that the first unmanned warehouse would be built before the Singles Day shopping festival on Nov 11 next year, emphasizing the company will make its business predominantly intelligent in the next 12 years.

Last year, it successfully used drones to deliver online purchases to rural shoppers in Jiangsu province. In November, it finished its first drone delivery in Xi'an, Shaanxi province. Moreover, robots and driverless cars for deliveries were used during the June 18 shopping festival.

"JD has taken a leading position in the domestic intelligent logistics sector and has invested a huge amount in related intelligent equipment, such as unmanned sorting and handling equipment, drones and driverless deliveries," said Lu Zhenwang, CEO of Shanghai-based Wanqing Consultancy.

Lu added the unmanned sorting system still had some limitations because it could not sort out large-sized home appliance products.

Amazon.com Inc, JD's rival in the global market, has stepped up efforts in the intelligent logistics sector. In December, it successfully trialled its Prime Air drone delivery service in UK, which is designed to safely deliver packages to customers in 30 minutes or less.

Amazon' fulfillment centers are already partially automated, with a growing number of centers using Kiva robots to carry shelves of products to human workers, who then pick the items to be shipped.

Nation keeps top spot in express deliveries

China has remained the world's largest market for the express delivery business since 2014, driven by the booming of e-commerce.

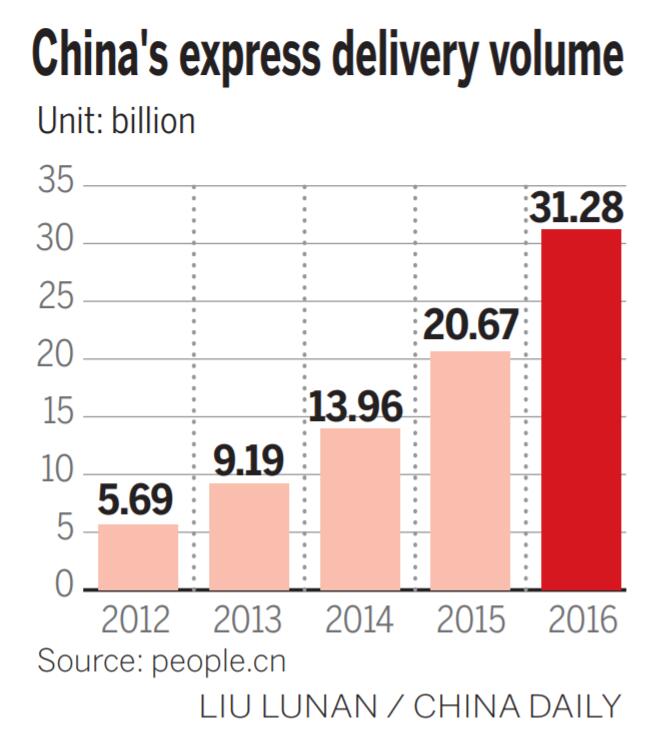

Data from the State Post Bureau show that the number of delivered parcels reached 31.28 billion in 2016, up from 20.67 billion in the previous year. In 2012, there were around 5.69 billion delivered parcels.

The express delivery market is booming as its annual growth rate has remained more than 50 percent in the past five years. The industry's revenue reached 397.4 billion yuan ($59.1 billion) in 2016, up 43 percent from 277 billion yuan in 2015.

A total of 84.62 percent of the parcels, traveling a distance of less than 1,000 kilometers, could be delivered within 48 hours. A robot could handle around 1,700 parcels every day.

The average delivery price per parcel declined from 18.6 yuan in 2012 to 12.7 yuan in 2016 amid fierce competition among major operators, including SF Holding Ltd, STO Express and YTO Express.

Moreover, the coverage rate of express delivery branches in counties and rural areas rose to 80 percent in 2016.

Analysts attribute the surge in express delivery services to the popularity of e-commerce, led by Alibaba Group Holding Ltd's Taobao, the country's largest online retail marketplace.

According to data from the China E-Commerce Research Center, China's e-commerce imports reached 1.2 trillion yuan ($174.17 billion) in 2016, growing 33.3 percent over 2015. The volume is expected to rise to 1.85 trillion yuan ($268.51 billion) this year.