High road to success

Updated: 2011-12-09 08:12

By Liu Wwei (China Daily)

|

|||||||||||

|

A boy looks at a Transformers 3 poster at a theater in Hubei province. Chinese audiences have more choices at cinemas after China's entry to the WTO. [Photo / China Daily] |

Filmmakers have gained considerably from China's WTO entry

When China joined the World Trade Organization in 2001, there was general apprehension in the film industry that it was akin to letting the wolf through the door. Such apprehensions were not unfounded as the film industry in China was still miniscule compared to that of the United States.

Box-office receipts in China during 2001 were just 890 million yuan ($143 million), with the highest-grossing film, A Family Drama, netting 20 million yuan. In contrast, box office collection in the US during that year was $8 billion, with the top grosser Harry Potter and the Sorcerer's Stone, alone raking in $317 million. So it was only natural that industry circles were not too enthused that, as part of the WTO entry requirements, the nation had to further open up its film market.

An immediate fall-out of the WTO entry was the marked increase in the number of foreign films hitting the Chinese screens. Prior to 2001, China imported 10 revenue-sharing foreign films for theatrical release every year, but had to double that number subsequently.

In the decade since then the film industry has undergone a sea change and no longer considers foreign films predatory, but rather complementary, as box-office receipts have been growing steadily and putting the industry on a sound footing.

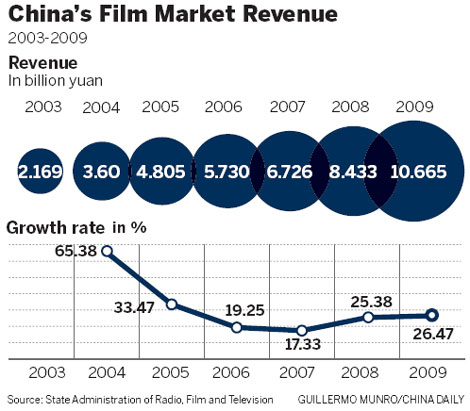

China's box-office collections reached a record 10 billion yuan in 2010, a 63.9-percent growth over 2009 and a steady increase of 30 percent since 2003. The nation has also become the most profitable overseas market for many big Hollywood blockbusters like Avatar and Transformers 3. In 2002 China had only 1,500 screens. That number has since then risen to over 7,000 screens by the end of June this year or in other words the addition of 4.2 new screens on a daily basis.

But the real impetus for the film industry in China in the post-WTO era has been the slew of government policies that have spurred growth. In 2002, a year after China joined the WTO, new regulations allowed the entry of more private and foreign capital in production, distribution and screening of films and removed the controls on these sectors by State-owned enterprises. The new laws also allowed local private companies to produce and distribute films independently and set up their own theaters.

It was these kind of measures that spurred several Chinese filmmakers to start their own ventures. Film producer Yu Dong, whose distribution company Bona Film Group Ltd is currently a listed entity on the Nasdaq, and actress Xu Jinglei, who set up her own studio in 2002, are some of those who took the initial strides.

Meanwhile, China also started to encourage co-productions between foreign and local filmmakers.

While about 50 foreign films, 20 on revenue-sharing basis and 30 imported with their financiers receiving a one-time fee and no cut of ticket sales, are allowed in theaters every year, co-produced films are exempt from the quota and treated as local productions.

Co-productions such as Hot Summer Days between Huayi Brothers and Fox International Productions, and The Karate Kid between Sony and China Film Group have enjoyed good box-office collections in China. Wang Zhonglei, president of Huayi Brothers, in an earlier interview had remarked that, the cooperation with Hollywood studios and his team was "like a sponge, absorbing and learning everything it could from the established studios", such as "developing an eye for budget details and global audience tastes".

Government protection played a key role in the industry's prosperity, said Ben Ji, who has worked with two major Hollywood studios and runs his own studio in Beijing. "China did well in capping the box-office revenue at 17 percent for foreign companies in China," he said.

And steps like welcoming foreign investors for film production, and the strict controls on distribution and theater business have put the industry on a sound footing. "Productions require a lot of money and is the most risky part of the film business, while distribution makes the easiest money," he said.

Foreign companies cannot distribute films in China directly, and have to find local partners, mainly China Film Group and Huaxia Film Distribution, the two State-owned companies. There are also strict regulations on the building of cinemas. China allows foreign investors to set up theaters in the country only through joint ventures with local companies, wherein they can hold a maximum stake of 49 percent.

But even as the industry is basking in the glory of better box-office receipts, there still needs a lot to be done for Chinese films to gain global attention.

Tong Gang, head of the State Film Bureau, the top industry regulator in China, in a recent interview had remarked that while it was good that the 2010 box-office receipts were around 10 billion yuan, Chinese films still have not been able to compete effectively with top grossers like Avatar and Inception.

He said that the two Hollywood blockbusters accounted for more than 20 percent of the box-office revenue in 2010. During the past five years 50 foreign films, mostly Hollywood productions, have taken the lion's share of box-office collections in China.

"We have to admit that China's box office still relies heavily on Hollywood blockbusters," said Geng Yuejin, an industry insider with more than 20 years of experience in distribution and theater business. "When a Hollywood blockbuster is shown it also leads to an increase in the admission rates to theaters."

But there are other tougher challenges on the horizon for Chinese filmmakers. While China has not given any specific timetable as to when it would comply with the WTO ruling in 2009 that seeks permission for foreign producers to distribute their films independently rather than through the two State-owned Chinese companies, some US studios have been working on alternative routes to access the market.

Relativity Media has partnered with two Chinese investment firms and State-owned Huaxia Film Distribution to set up a joint venture named SkyLand, which will develop, produce, distribute and acquire Chinese material that possesses worldwide appeal. Legendary Entertainment and Huayi Brothers have set up their own joint venture, Legendary East, to produce and distribute "global" flicks.

This way, American firms like Legendary and Relativity bypass the import restrictions. Such agreements guarantee movies a release in China and can improve the percentage of box-office receipts the US producers can collect to about 40 percent.

Aside of the challenges, there are also opportunities for local filmmakers, said Geng.

"Working with Hollywood, if taken in the right way, can produce great works with global attractions," he said. "It also provides a good chance for Chinese filmmakers to learn finer aspects like professionalism, industrial system and the risk control."