Insurers adapt to new system

Updated: 2011-12-09 08:09

By Hu Yuanyuan (China Daily)

|

|||||||||||

Cai Qiang, CEO of American International Assurance Co Ltd (China), attributed the lower-than-expected performance of foreign insurers to the aftermath of the 2008 financial crisis and frequent changes to senior management.

But Cai is still confident about the prospects of foreign insurance companies, which he said were all strongly committed to long-term investment in China.

"China's insurance market is at a fledgling stage. It will soon see some rapid growth followed by maturity," Cai said.

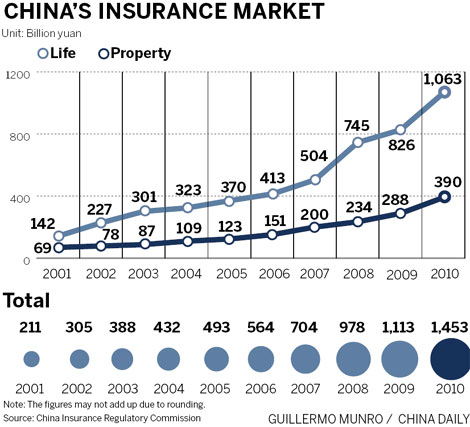

In the meantime, the premium income of domestic insurance companies rose to 1.39 trillion yuan, 6.7 times that in 2001; their total assets reached 4.78 trillion yuan, 9.8 times that of 10 years ago, said Hao Yansu, dean of the School of Insurance at Central University of Finance and Economics.

Hao said localization was the biggest hurdle foreign insurers faced in attracting more Chinese customers.

"Due to some restrictive policies, foreign insurance companies don't enjoy the same treatment as domestic companies," he said.

A common difficulty has been getting approval to set up branches in China, which restricts the expansion of foreign insurers, he explained.

In recent years, joint ventures have been seeking to circumvent these restrictions and realize growth by reducing their foreign-funded stake to lower than 25 percent, which means they are classed as a domestic company.

PICC Life Insurance Co Ltd (PICC) was established in 2005 with a combined 49 percent stake shared among Bangkok Bank, Asia Financial Group and Sumitomo Life Insurance. In 2007, the foreign stakeholders agreed to reduce their stake to 20 percent.

Last year, PICC's premium income totaled 84.5 billion yuan, a year-on-year increase of 60 percent, with its assets worth more than 186 billion yuan.

After Sun Life Everbright Life Insurance Co Ltd changed its stakeholding structure in September last year, Sun Life Assurance Company of Canada took a 24.99 percent stake while China Everbright Group took 50 percent.

China North Industries Group Corporation and Anshan Iron and Steel Group Corp each held a 12.505 percent stake as strategic investors.

Hao predicted that such a practice would become a trend.

After China's entry into the WTO, though domestic insurance companies lost some market share, they gained valuable business experience, Hao said.

Zhang Li, president of Haier Meiji Yasuda Life Insurance Co Ltd, a joint venture based in Shanghai, holds a similar view.

Chen Keyu contributed to this story.

Related Stories

AIA stays ahead with 'back to basics' plan 2011-12-09 08:09

Good things in store for Chinese life insurers 2011-12-09 10:55

Foreign insurers' market share remains low: Study 2011-12-06 07:58

China may open auto insurance to foreign firms 2011-11-21 13:22

- Chinese shares close lower after data release

- Passengers prepare for annual peak

- Home appliance sales in rural China up 66% in Nov

- Collective wage talks promoted

- Good things in store for Chinese life insurers

- Dotcom could fall into disuse

- Global supermarkets conquer China

- China's Nov CPI up 4.2%, PPI up 2.7%