Snow: Trade action against China won't work

(Reuters)

Updated: 2006-01-06 15:15

WASHINGTON - U.S. Treasury Secretary John Snow urged China on Thursday

to allow further revaluation of its currency, the yuan, saying it would help

world economies adjust from trade and current account imbalances, but warned

against retaliatory trade measures.

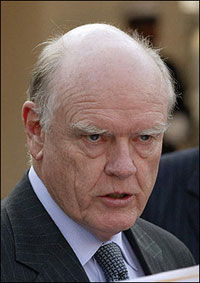

Treasury Secretary

John Snow, pictured here in 2005, warned against trade measures

against China in a call-in TV program on January 5, 2006.

[AFP] | "The trade deficit is influenced by lots

of things, differential growth rates, differential savings rates and investment

rates and so on. But clearly, getting the yuan more appropriately valued will be

helpful to the global adjustment process," he said on CSPAN television.

But Snow defended the administration's decision not to formally cite China as

a currency manipulator, saying U.S. pressure on Beijing has been effective and

that Chinese policy-makers recognize further revaluation is in their national

interest.

"They are putting in place mechanisms to allow their currency to have greater

flexibility... so I think we're on the right course," Snow said.

If the United States tried to pressure China to adopt a more flexible

currency through trade actions against Chinese imports, it might only result in

corresponding measures against the United States and create market uneasiness,

he warned.

U.S. manufacturers complain that, even after a modest revaluation of its yuan

currency last July, China's currency remains seriously undervalued and that lets

China unfairly run up steadily mounting surpluses on its trade with the United

States.

"China's behavior is inviting lots of negative reaction in the Congress,"

Snow said in response to questions after an address to the U.S. Chamber of

Commerce.

"They do need to clean up their act on intellectual property, they do need to

understand that trade is a two-way street," Snow said. "We're not satisfied one

bit on the currency issue, but it's awfully important we resist these

protectionist pressures."

(For more biz stories, please visit Industry Updates) |