Sinopec calls for new oil pricing mechanism

(China Daily)Updated: 2007-01-19 08:38

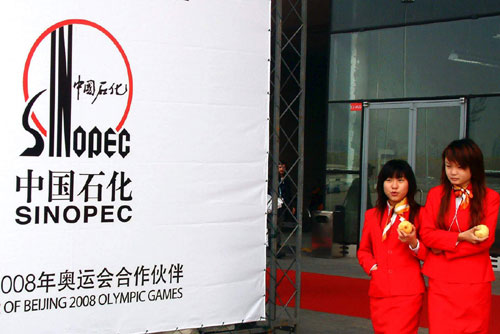

A Sinopec billboard in Shanghai. The company wants pump prices to follow market fundamentals after world crude oil prices soared to all-time highs in 2006. [newsphoto]  |

"Under harsh market conditions, it is understandable for the refiner to slow down refining growth and even to import oil products from overseas to cover the deficit and to meet demand," Liu said.

Sinopec supplies around 80 percent of the fuels sold in China, working under rigid price controls that limit fluctuations within an 8 percent range.

As global prices soared in 2006 and import costs jumped, the refiner saw its loss widen to 12.6 billion yuan in the third quarter of 2006, compared to a 6.6 billion yuan loss a year earlier. Sinopec imports about 70 percent of the crude oil it uses for refining.

A more market-oriented oil product pricing mechanism would certainly be a shot in the arm for the development of Sinopec, Liu confirmed.

| 1 | 2 |

(For more biz stories, please visit Industry Updates)