Debate on bulls and bears froths over

(China Daily)Updated: 2007-02-09 10:39

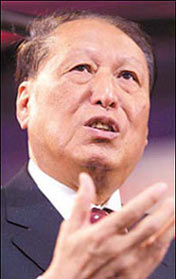

Cheng Siwei:About 70 percent of domestic A-share companies were not worth investing in. Individual investors should make rational decisions even in a bull market. |

This has become the central point of a fierce debate in the Chinese stock market.

Cheng Siwei, vice-chairman of the Standing Committee of the National People's Congress, told the Financial Times in late January that about 70 percent of domestic A-share companies were not worth investing in, and urged individual investors to make rational decisions even in a bull market to ward off risks posed by market bubbles.

Earlier, US investment guru Jim Rogers, who co-founded the Quantum Fund with billionaire financier George Soros, said on CCTV that many Chinese listed companies are overvalued and a bubble was forming.

The markets were bullish when they made the comments but on the last day of January, the domestic A-share market suffered a 144 point, or 7.2 percent, tumble and. Cheng was held by many as the major culprit for the fall.

Liu Jipeng, professor at Capital University of Economics and Business, tried

to refute Cheng in early February. Liu, who also chairs a financial consulting

company, said it is normal for any market to have bubbles.

| 1 | 2 |  |

(For more biz stories, please visit Industry Updates)

| ||