Dabao sale inflames debate over local brands

By Diao Ying (China Daily)Updated: 2007-04-04 09:13

The 2.3-billion-yuan acquisition of Chinese cosmetics firm Dabao is set to be the biggest in the industry by value, and the successful bidder is likely to be announced soon.

Beijing Dabao Cosmetic Co has total capital of 645 million yuan and was put up for sale on the Beijing Equity Exchange in February.

Bidders had until March 26 to submit their offers for the company. Bid information was withdrawn by that date a sign that Dabao may have found a buyer.

Several foreign firms were reportedly vying to buy the company, including Avon, Unilever and Johnson & Johnson.

Frank Braeken, chairman of Unilever's Greater China operation, told Reuters the company was considering bidding for Dabao. "We believe that Dabao could be complementary in our portfolio," he was quoted as saying.

On March 26, the Shanghai Securities News quoted a person close to the deal as saying that Johnson & Johnson had won the bid.

Competition to buy Dabao reflects foreign firms' enthusiasm to break into China's $500-billion retail market, which continues to grow by double digits.

The cosmetics industry is seen as particularly lucrative.

"Demand for cosmetic products is booming as the living standards of Chinese

improve," said Chen Shaojun, from the China Association of Fragrance Flavor and

Cosmetic Industry (CAFFCI).

The cosmetics industry is seen as particularly lucrative.

"Demand for cosmetic products is booming as the living standards of Chinese

improve," said Chen Shaojun, from the China Association of Fragrance Flavor and

Cosmetic Industry (CAFFCI).

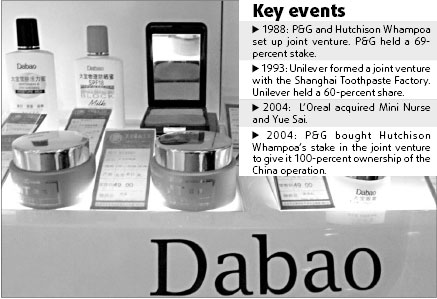

Before the Dabao sale, L'Oreal acquired two Chinese cosmetics companies in 2004 Mini Nurse and Yue Sai.

Acquiring local brands enables foreign companies to enter the market. Dabao is one of the best-known cosmetic brands for low and medium-end cosmetics. It has over 3,000 outlets in China and is especially popular in second-tier cities the market Johnson & Johnson is keen to explore.

But the Dabao sale has sparked calls to protect domestic brands. Previous acquisitions have seen well-known Chinese brands fade or even disappear after being swallowed up by foreign firms.

Washing powder brand Panda, for instance, went from producing 60,000 tons in 1994 to 4,000 in 2000 after Procter & Gamble's 50-year lease contract. The brand previously had a 10 to 15 percent market share but is rarely seen in stores now.

But mergers and acquisitions are common in an openly competitive environment, and are a strategic choice for companies to develop, according to analysts.

They said Dabao's development had been stable prior to the sale. It is one of seven well-known cosmetic brands in China, according to the CAFFCI. Dabao in 2006 posted 41.7 million yuan in net profit on sales of 675.2 million.

"It has chosen to sell itself to develop further," said Chen from the association. "And the deal may be good for the brand."

"Domestic brands will not disappear because of a single acquisition," said Chen, adding that there are around 3,500 domestic cosmetic brands now. In the long run, foreign and domestic brands will co-exist and compete in the market, he said.

Dabao said in a statement its brand would be preserved after the acquisition. "That is a lesson other local brands could learn from Dabao," Chen said. "The brand itself represents the efforts of a whole generation, and should be cherished."

(For more biz stories, please visit Industry Updates)

| ||