Top Biz News

Property market still hot despite cooling measures

By Zhang Yu (China Daily)

Updated: 2007-04-20 08:28

|

Large Medium Small |

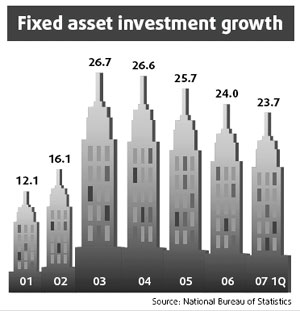

The nation's sizzling real estate market recorded strong growth in the first quarter despite the government's effort to cool down the industry.

The investment numbers rose sharply in many parts of the country despite three lending rate increases in the past year.

According to statistics released by theNational Development and Reform Commission(NDRC), real estate investments totalled 354.38 billion yuan ($45.9 billion) in the first quarter. The figure represents a first-quarter growth of 6.7 percent compared to the same period last year.

According to statistics released by theNational Development and Reform Commission(NDRC), real estate investments totalled 354.38 billion yuan ($45.9 billion) in the first quarter. The figure represents a first-quarter growth of 6.7 percent compared to the same period last year.

Geographically speaking, investments in the east, middle and western parts of the country grew 24.3 percent, 36.2 percent and 29.3 percent, respectively in the first three months.HenanandAnhuiprovinces saw jumps of 59.1 percent and 52.4 percent, respectively.

Last year, real estate investments grew just 21.8 percent on average. That was credited to macro-control measures imposed by the government since 2003.

Thus, the first quarter's growth contradicts the objective of the government's cooling measures. The NDRC characterized it as being "a bit faster".

Yang Hongxu, an analyst fromShanghaiE-house Research Institute, said: "To my surprise, real estate investment in China has continued to expand after more than half a year's cooling measures by the government."

Since early last year, the central government has intensified its macro-control measures in the real estate sector with changes in land, tax, foreign capital and interest rate policies.

Since last April, the central bank raised the one-year benchmark lending-rate three times, each at a rate of 27 basis points that sought to increase the price of capital and tighten the money supply.

Recently, some predicted new increases were needed.

Yang Qing, head of research at Colliers InternationalBeijingoffice, said: "I believe the central bank will probably raise the interest rate again to curb the investing sentiment in the real estate sector."

He said three previous hikes had no clear impact on the market.

As banks try to tighten the flow of money, real estate developers have been trying alternatives to meet their financial needs. Some domestic developers, especially smaller ones, have complained.

As the capital market matures, developers are getting more options such as debts, trusts and securities. They can also attract more foreign capital, as the yuan is on a positive course and the domestic real estate market becomes more transparent.

According to the report by the NDRC, non-banking financial institutions lent 12.64 billion yuan in the first quarter to the real estate sector, a rise of 66.9 percent from last year.

In the meantime, 13.13 billion yuan was pumped into the real estate industry by foreign companies, a rise of 154.4 percent from last year. Direct investment by foreign markets reached 10.27 billion yuan, an increase of 192.5 percent.

Measures to curb foreign investment in the real estate market seemed to have the opposite affect.

For example, more than 100 real estate investment funds are in search of opportunities.

"Nearly every week, we receive enquires from our foreign clients about the real estate market conditions in Beijing," Yang Qing said.

(China Daily 04/20/2007 page4)

| 分享按钮 |