Stocks rise for 6th day, regain 4,000-point foothold

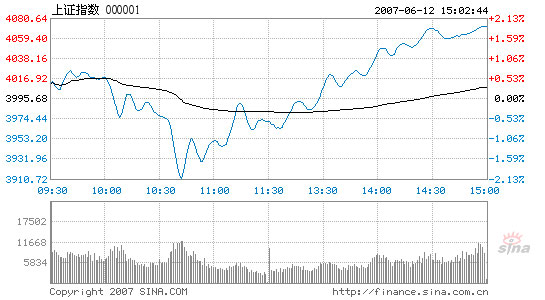

By Li Zengxin (chinadaily.com.cn)Updated: 2007-06-12 15:54 Chinese stocks rose for the 6th consecutive trading day and took back the 4,000-point battlefield today. The Shanghai Composite Index closed at 4,072.14, up 76.64 points or 1.91 percent from yesterday's closing.

The release of a 3.4 percent rise in the consumer price index by the National Bureau of Statistics (NBS) this morning had little impact on the stocks, at least not for long.

The stocks responded by a few slides after opening higher from 4,011.68, the deepest seen at around 10:30, as the bench mark index dropped 60 points in minutes to touch the daily lowest point of 3,910.00. It then started to escalate in waves to cross the critical line again, and finish on an uprising path to just a little lower than today's highest 4,073.18.

Shanghai Composite

Index

Source: www.sina.com.cn

Total turnover of the stocks enclosed by the major indices was 318.7 billion yuan, much larger than that of yesterday.

China Unicom, with the largest trading volume, slid 0.03 yuan, while Sinopec, with the largest transaction value, added 1.17 yuan to its share price.

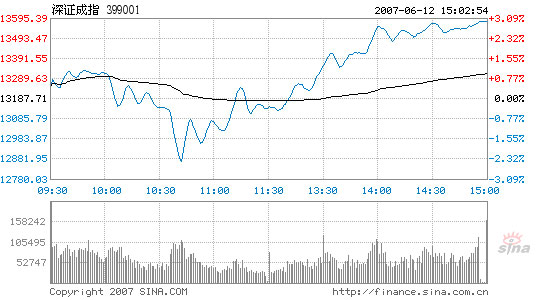

The Shenzhen Component Index, tracking the smaller Shenzhen Stock Exchange, closed at the daily highest point of 13,579.72, up 392.01 points or 2.97 percent. It toughed the lowest of 12,865.98 around the same time when the Shanghai index hit a bottom.

Shenzhen Component

Index

Source: www.sina.com.cn

Of its A shares, 372 went up, 172 down and 67 unchanged. Sichuan Jinlu Group was on top of the gainer's list, while Shenzhen Century Plaza Hotel fell most. Anhui BBCA Biochemical, with the largest trading volume, rose 10 percent; while China Vanke, with the largest transaction value, slipped a little.

Stocks in the transportation, metal and hydroelectricity industries gained the most from today's trading. Shanghai Yatong climbed 10.06 percent up to pioneer the transportation and logistics sector. Paper makers also performed well.

B shares ended up. Of the 109 B shares listed on the two exchanges, 59 rose but 44 slumped. Shanghai Tire and Rubber surged 10.02 percent to lead the others on the B-share ranking list.

The stock market has been recovering from the loss for six consecutive days including today. Total market value of all securities listed on the two exchanges was 17.33 trillion yuan by yesterday's closing, close to the figure on May 30, the day following the stamp tax hike when the stocks plunged 6.5 percent.

But the number of new accounts opened last week lagged behind the trend and

kept shrinking. For the whole week except Wednesday, new investment accounts on

the two exchanges were below the 200,000 mark.

New account

opening

Source: China Depository and Clearing Co

Ltd

|

Date |

A Share |

B Share |

Fund |

Total |

|

2007-06-04 |

197,324 |

2,656 |

40,505 |

240,485 |

|

2007-06-05 |

162,190 |

2,396 |

24,470 |

189,056 |

|

2007-06-06 |

205,901 |

3,111 |

17,196 |

226,208 |

|

2007-06-07 |

180,404 |

2,747 |

27,678 |

210,829 |

|

2007-06-08 |

194,678 |

2,699 |

22,221 |

219,598 |

By June 8, there were 103.3 million investment accounts in the Chinese mainland, including 89.4 million A-share, 2.2 million B-share and 11.7 million fund accounts.

Now that the statistics for May have been released, many began to fear the central bank may issue tightening measures under the apparent excessive liquidity problem. Analysts believe if the People's Bank of China raises the interest rates or bank reserve ratio again, the stock market is for sure to be affected, but not as much as the stamp tax hike has done, as an interest rate change is not merely targeting the stock market.

NBS said today that the consumer price index (CPI) was up 3.4 percent year-on-year in May. Urban CPI rose 3.1 percent, while rural CIP rose 3.9 percent; food price rose 8.3 percent abd non-edible goods were up 1 percent; consumables were up 3.9 percent while services were 1.7 percent more expensive.

Compared with April, CPI in May was up 0.3 percent. The average CPI for the first five months of this year climbed 2.9 percent over the same period last year.

Food price, the heaviest-weighted component in CPI, rose 8.3 percent last Month. Of its constituents, egg price had the largest growth rate of 37.1 percent, followed by meat and poultry with a 26.5 percent increase.

In addition to a rising CPI, China's trade surplus in May reached US$22.45 billion, up US$5.47 billion than that of April and slightly lower than the US$23.76 billion in February, the largest to date this year. For the first five months this year, the total trade surplus had accumulated to US$85.72 billion, close to that of the whole 2006.

The resurgence of trade surplus, brings the excessive liquidity problem to the spotlight. The central bank is mostly likely to hike required bank reserve ratios, said analysts.

(For more biz stories, please visit Industry Updates)