Center

Stocks drop 1.47% with low trading volume

By Li Zengxin (chinadaily.com.cn)

Updated: 2007-06-14 16:02

|

Large Medium Small |

|

||||||

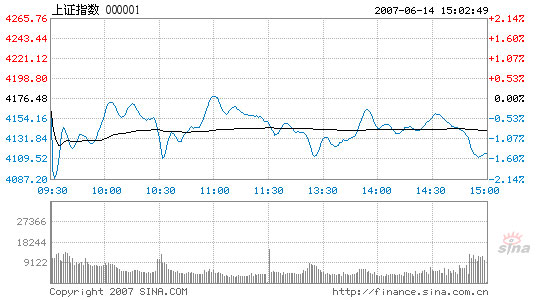

The Shanghai Composite Index closed at 4,115.21, down 61.27 points or 1.47 percent from yesterday's closing.

The benchmark index opened lower from 4,162.21 and plunged to 4,085.79 as the daily lowest within minutes. Then it turned around but failed to form a clear trend in a series of frequent but short-tailed fluctuations. It once hit the highest 4,179.73 at 11:00 but fell soon later.

Shanghai Composite Index

Source:www.sina.com.cn

At the Shanghai bourse, 226 stocks saw their prices rise, while 559 fell and 54 closed flat. Shanghai Tongda Venture Capital rose 10.04 percent to 15.4 yuan as the top gainer. Chongqing Gangjiu and Inner Mongolia Yili Science and Technology Industry were also sealed at the maximum rising cap of 10 percent. On the other end of the table, Ningbo United Group dropped 7.11 percent as the biggest loser.

China Unicom, with the largest trading volume, slid 0.16 yuan while Younger Group, seeing the largest transaction value, added up 1.62 yuan to its share price.

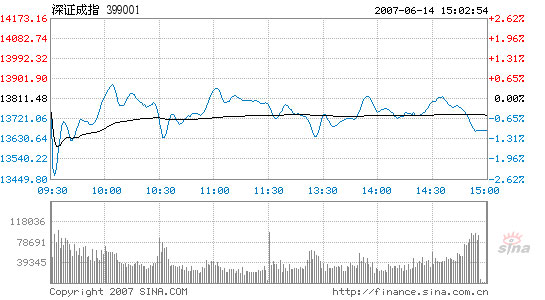

The Shenzhen Component Index, tracking the smaller Shenzhen Stock Exchange, ended at 13,666.28, down 145.2 points or 1.05 percent. It went through the day within a range from 13,464.49 to 13,874.48.

Shenzhen Component Index

Source:www.sina.com.cn

Of its A shares, 162 went up, 382 down and 69 unchanged. Qingdao Jiante Biological Investment saw its price rise 10.03 percent as the top gainer. While China Dalian International Group dropped 6.42 percent to lead the fall. TCL, with the largest trading volume, was up 0.11 yuan while China Vanke, with the largest transaction value, lost 0.6 yuan.

Stocks in the commodity retail and wholesale, timber and mining industries grow fastest against a depressing trend. Fujian Dongbai Group rose 7.6 percent to pioneer the commodity trade sector. Textile industry also performed well today.

B shares fell. Of the 109 B shares listed on the two exchanges, only 13 went up and five ended flat. Hainan Pearl River Holdings again took the first place in the gainer's list.

The resurgence of Chinese stocks in the past seven trading days in a row has lifted the total capitalization in the stock market and raised new concerns over possible bubbles.

| 分享按钮 |