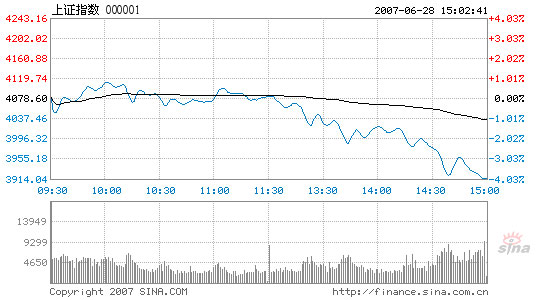

Index falls 4.03% as panic grows among investors

By Li Zengxin (chinadaily.com.cn)Updated: 2007-06-28 15:49

Chinese stocks plunged 4.03 percent as panic grew among investors amid

concerns on the issuance of 1.55 trillion yuan of special T-bonds and a possible

slash on interest tax. The Shanghai Composite Index closed at 3,914.20, down

164.39 points, the largest single-day slump since June 4.

Lawmakers

yesterday debated a bill authorizing the State Council to cut or suspend tax on

interest accrued from bank deposits - a move seen as helping rein in excessive

liquidity and expected to be passed on tomorrow's voting by the National

People's Congress.

Besides a slash in the tax on interest, China is mulling a series of measures to address the excessive liquidity problem. The national legislature debated a draft bill authorizing the Ministry of Finance (MOF) to sell 1.55 trillion yuan of special treasury bonds to finance the proposed foreign exchange investment company. Analysts believe the issuance of the bonds may reduce liquidity in the market.

The funds raised will be used to buy US$200 billion of the country's total of US$1.2 trillion foreign exchange reserves from the central bank, and invested overseas. The bill, submitted by the State Council to the Standing Committee of NPC, is expected to be approved tomorrow.

Today's total turnover of the stocks enclosed by the two major indices was 191.9 billion yuan, the second-smallest since May 29, after June 14 with a 185.4 billion yuan turnover.

Like on most of the recent volatile trading days, the benchmark Shanghai Composite Index ran through the morning session in short-tailed fluctuations without forming a clear trend. After a higher opening from 4,080.19, the index hit the highest 4113.28, but failed to stay. In the afternoon, however, it met little resistance on a way of descending. Finally, it closed a little higher than today's lowest point of 3,912.81, again losing the 4,000-point mark regained just yesterday.

Shanghai Composite

Index

Source: www.sina.com.cn

Of the A shares listed in Shanghai, merely 67 went up, 704 dropped and 68 finished unchanged. Shanghai Broadband Technology was up 29.15 percent on top of the gainer's list. Beijing Tianhong Baoye Real Estate and Jiangxi Hongdu Aviation Industry also grew nearly 10 percent as the biggest gainers. Zhejiang Furun, on the other hand, dropped 10.06 percent to lead the fall by the large number of losers today.

Inner Mongolian Baotou Steel Union became the largest trader in terms of

trading volume, and rose 7.37 percent to 6.99 yuan. China Yangtze Power, with

the largest transaction value, was up 6.03 percent. But the dual couldn't lift

the index as other large traders were mostly dragging it down.

| 1 | 2 |  |

(For more biz stories, please visit Industry Updates)