China's indices survive global decline overnight

Updated: 2007-07-27 17:18

In spite of heavy overnight losses on Wall Street and the European markets, major indices in the Chinese stock market managed to recover from a lower start and closed almost flat.

Although the index didn't conclude the week with another new high, the market's upward trend is unshakable – a belief held by investors both at home and abroad.

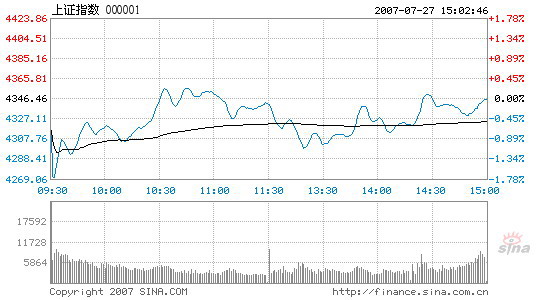

Reflecting the overseas plunge on Thursday, the Shanghai Composite Index opened at 4315.37, down 0.72 percent. After a quick dive to the day's lowest of 4268.79 several minutes later, the index swung upward to the psychologically important 4300-point level. It ended the week's trading at 4345.36, a slim decline of 1.1 points from Thursday's close, although this historic week has witnessed a 313-point gain together with a record high.

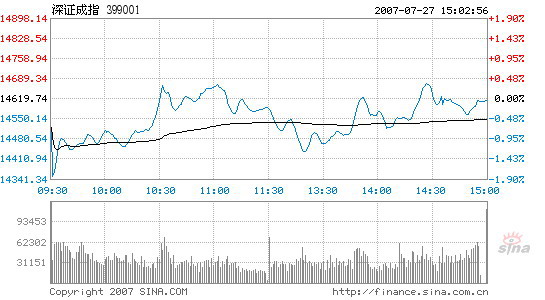

The Shenzhen Component Index opened at 14518.81, down 100 points from its previous close. But it also managed to reclaim most lost ground and closed at 14614.1, down only 0.04 percent.

Shanghai Composit Index

Source: www.sina.com.cn

Transaction value of the Shanghai and Shenzhen markets reached 139.2 billion yuan and 75.9 billion yuan respectively, slightly higher than the last trading day, with 1005 stocks closed up, 136 down, and 318 flat.

In a related move, the leadership of the Communist Party of China held an economic meeting on Thursday, discussing the current economic situation and calling on some local governments to prevent China's blistering economy from overheating. Policies encouraging energy saving and pollution emission cut were also reiterated on the meeting, which was well echoed by the market today.

Shares of energy, agriculture, and environmental protection sectors performed well. Feida Environmental Science surged over six percent to 20.67 yuan. Meanwhile the heavy weight banking sector declined mildly in response to the possible tightening measures on financial institutions. China Merchants Bank, one of the nation's leading lenders, dropped 2.16 percent to 29.02 yuan from yesterday's highest 30.37 yuan per share.

In contrast, Hong Kong stock markets failed to shake off negative impacts from overseas markets. The benchmark Hang Seng Index lost 2.76 percent on Friday and closed at 22570.41.

Analysts said the robust mainland indices are great reflection of investors' confidence in the Chinese economy. Although some people used to be worried about the short term trend during the correction of the past month, few had ever doubted the nation's economic future. When negative factors or prospects are smashed or fully absorbed by the market, positive ones like sound corporate earnings and appreciation of renminbi began to take greater effect and drew the indices to a record high.

This optimism comes not only from Chinese investors. Fund manager and investment author Jim Rogers surprised people on Thursday by saying that China's bullish stock market might last 80 years. Although an exaggeration, the words drew international attention to the Shanghai and Shenzhen markets.

|

|