Indices fall 170 points, or 3.81% from a new high

Updated: 2007-08-01 17:34

Major Chinese stock indices suffered their greatest loss in four weeks on Wednesday, a result of a sizeable sell-off and internal corrections, after surging nearly 1000 points in the last month.

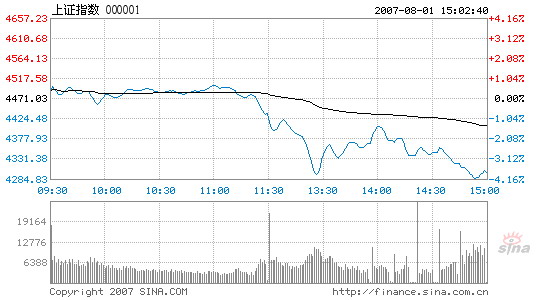

The benchmark Shanghai Composite Index continued its booming trend in the morning with a record-high open of 4488.77 points, but failed to hold on under huge selling pressure. After briefly touching the 4500 point level midmorning, the index began a steep dive that continued through remaining trading hours. It plunged downward to 4300 points and reached the day’s lowest of 4284.87 points before close. Although bargain hunters pushed the index up a little to 4300.56 in the end, the index still lost 170 points or 3.81 percent within the day, the largest since July 5. Trading value of the market climbed to 173.2 billion yuan, some of which is attributed to panic selling in the afternoon.

| Shanghai Composite Index Source:www.sina.com.cn |

|

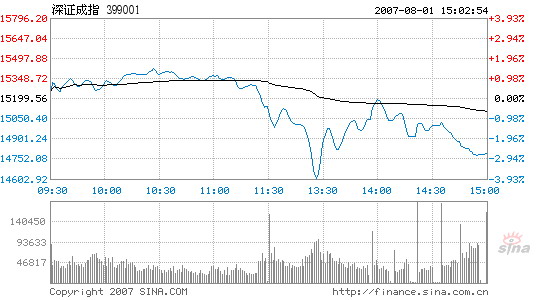

The Shenzhen Component Index also took in a huge downturn of 2.66 percent and closed at 17495.2 points, with a turnover of 96.6 billion yuan.

| Shenzhen Component Index Source:www.sina.com.cn |

|

Profit-taking dominated the market today. Of all the stocks, only 147 closed up, 113 unchanged. The rest 1199 went down. Stocks that saw huge rises in the past days suffered the most, and some even ended at the loss limit of 10 percent.

Sectors of metal, coal and securities incurred an average loss of over three percent today. Haitong Securities, which just finished its backdoor listing process yesterday, fell 6.68 percent to 48.20 yuan. Chalco, the nation’s leading aluminum producer also failed to maintain yesterday’s jump and dropped 5.62 percent.

However, blue chips proved relatively resistant to the correction due to their stable revenue growth. Sinopec declined, but by only 1.48 percent to 13.99 yuan per share. Baoshan Iron & Steel fell 2.22 percent and closed at 13.19 yuan.

In a related occurrence, stock markets all over the Asia Pacific region suffered similar losses today. The Hang Seng Index of Hong Kong dropped 3.31 percent in the morning session. The Nikkei index closed down 377 points or 2.19 percent. Bourses in South Korea, Singapore, and Taiwan experienced the same. Dealers said the disappointing performance of United States stock market in the past days affected Asia and created panic among investors.

However, drops in neighboring markets could be little more than an excuse for the dive in the A-share market today. Market watchers said the internal requirements for a thorough price correction served as a major factor.

In the past month, the index surged from 3600 points to the all-time high above 4500 points without a decent correction. Some stocks repeated the crazy performances staged before May 30 when the government had to cool excessive speculation with a hike in the stamp tax.

Securities analysts suggested investors not panic about today’s plunge. What they need is an overall review of their investment strategy and persistent hopes for the nation’s economy in the long run. Assuming indices will continue an overall upward trend, said one analyst, a correction is still indispensable and even helpful in squeezing out blundering profit-taking funds.

|

|