Stocks slip after violent swings

Updated: 2007-08-10 16:20

Chinese stocks slowed their march up to higher ground and experienced violent price adjustments today. The Shanghai Composite Index recovered from a sudden slump in the mid-session and finished almost flat.

Total turnover of the stocks enclosed by the major indices was 224.9 billion yuan, higher than yesterday.

Shanghai Composite Index

Source: www.sina.com.cn

The benchmark Shanghai index opened lower from 4,745.18 and edged up to a high of 4,769.62, but then suddenly fell 100 points to a low 4,640.77 just before the noon break. In the afternoon, it regained its footing to finish down 4.73 points or 0.1 percent to 4,749.37.

Of the A shares listed in Shanghai, 187 went up today, while 586 closed down and 69 finished flat. Zhejiang Jianfeng Group, rising 10.03 percent to 8.12 yuan, topped the gainers' list to lead another 14 stocks with around 10 percent growth on the first places. Beijing Vantone Pioneer Real Estate, however, dropped 10 percent to make the bottom of the list.

The Industrial and Commercial Bank of China, with the largest trading volume, gained another 2.29 percent, helping lift the whole index from a steep plunge. Chalco, with the largest transaction value, was up 9.89 percent to 35.89 yuan.

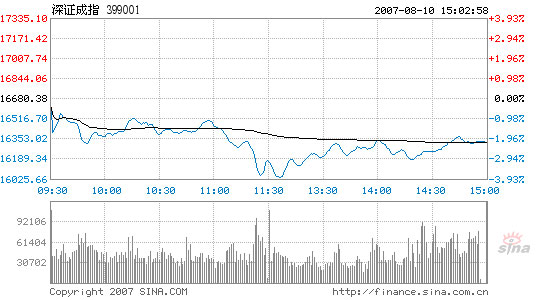

Shenzhen Component Index

Source: www.sina.com.cn

The Shenzhen Component Index, without many index-driven heavyweight stocks, performed much worse than its Shanghai counterpart. Opening lower from 16,606.83, it went through the day within a range of 16034.19 to 16,606.83, both lower than yesterday's closing level. The index closed at 16,323.44, down 356.94 points or 2.14 percent.

Of the A shares, 114 went up, 439 closed down, and 72 ended unchanged. New shares Western Metal Materials, Beijng Beiwei Communications and Jiangsu Tongrun Tool Cabinet went up 415 percent, 264 percent and 221 percent respectively, on the top of the growth list.

Panzhihua New Steel and Vanadium, with the largest trading volume, rose 10.05 percent while China Vanke, with the largest transaction value, slipped 4.47 percent.

Stocks in the paper, hydropower, and information technology sectors performed better than the others. Both closed-end mutual funds and B shares were down. Of the 109 B shares, only 15 went up and 8 ended flat.

|

||

|

|