Stocks tumble amid price adjustments

By Li Zengxin (chinadaily.com.cn)

Updated: 2007-08-29 16:34

Updated: 2007-08-29 16:34

Chinese stocks continued price adjustments today, with both indices mostly running low through the day.

Some experts believe the special bond issuance today may have resulted in the sluggish performance, but more saw the performance as an inevitable correction phase as stocks have been breaking historical highs for more than a week.

Total turnover of the stocks in the major indices shrank to 249 billion yuan (US$32.98 billion).

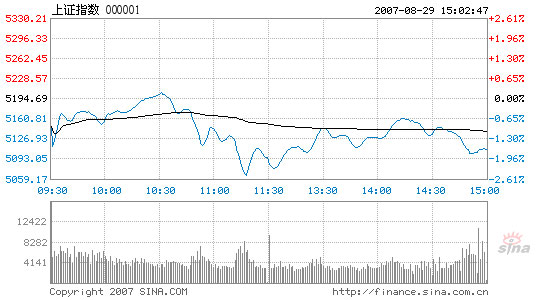

Shanghai Composite Index

Source: sina.com.cn

The Shanghai Composite Index opened lower at 5,063.41 and ran through the trading session under yesterday's closing level except for once hitting the 5,204.53 at 10:30. It also fell past the 5,100-point mark to 5,063.41 twice. Losing support by large cap blue chips, the index finished at 5,109.43, down 85.26 points or 1.64 percent.

Of the A shares listed in Shanghai, 282 went up, 496 closed down and 64 remained unchanged. Twenty stocks were sealed at the maximum daily growth limit of 10 percent, led by Xinjiang Talimu Agriculture Development, rising to 8.31 yuan on a 10.07 percent surge. The Industrial and Commercial Bank of China, with the largest trading volume, lost 2.61 percent while Chalco, with the largest transaction value, added up 0.38 yuan to its share price.

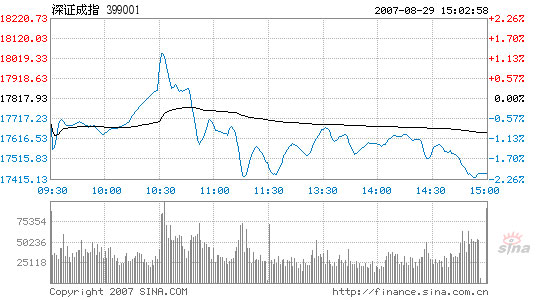

Shenzhen Component Index

Source: sina.com.cn

The Shenzhen Component Index, tracking the smaller Shenzhen Stock Exchange, closed at 17,443.19, down 374.74 points or 2.1 percent from yesterday's close. Opening lower from 17,688.62, it went through the day within a range between 17,418.53 and 18,051.72.

Of the A shares listed on the Shenzhen bourse, 192 rose, 371 fell and 76 ended flat. Beijing Shougang was the most heatedly traded share in terms of trading volume and surged 2.3 percent. Another large trader China Vanke, however, fell to 34 yuan after a 0.79 yuan cut in price.

Stocks in the commercial trade industry were stronger than the others as Lanzhou Minbai Shareholding Group led half of the listed retail and wholesale businesses on a surge. Both B shares and listed closed-end mutual funds were down today.

|

|